Sui’s native token (SUI) traded near $2.74 on July 2. The token gained about 1.75% on the day but stayed stuck below key resistance, holding inside a clear downtrend since May. New spot crypto ETFs expected in late 2025 could add fresh liquidity for Layer-1 tokens like SUI.

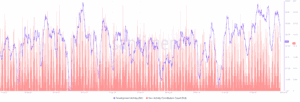

As per token’s 1-day chart, the token tested its falling trendline near $2.80–$3.00 but failed to break through. The token still trades below its 20-day exponential moving average ($2.84) and 50-day EMA ($3.03). These levels often act as barriers during weaker trends.

The relative strength index (RSI) sits near 43.7, showing buyers have not regained strong control. An RSI below 50 suggests momentum remains on the weaker side.

Bitcoin traded near $111,000 and Ethereum traded near $6,200 at press time. Both major coins are flat this week, giving SUI no broader market push to break resistance.

TVL Holds Above $1.7B But Below 2025 Highs

While the SUI price stays pinned under resistance, its total value locked (TVL) remains stable near $1.743 billion, down slightly by 0.15% in the last 24 hours. TVL measures how much crypto is locked inside DeFi projects.

Sui’s TVL climbed from about $500 million in mid-2023 to above $2 billion earlier this year but has since slipped by about 15% from its peak. By comparison, Solana’s TVL sits near $4.5 billion and Avalanche’s is around $1.1 billion, placing Sui in the middle of the Layer-1 pack.

Stablecoins make up about $1.051 billion of Sui’s TVL, providing liquidity for lending and trading.

This steady locked value connects to real usage. Daily chain fees reached about $27,685, while apps on Sui generated $369,795 in the last 24 hours. App revenue for the same period is about $130,547.

Sui’s decentralized exchanges handled about $242.87 million in daily trades. Perpetual futures trading added about $73.96 million in volume. Bridged assets — coins moved from other chains — remain strong at about $2.4 billion, showing steady cross-chain use.

Behind these usage figures, developer activity shows how much building still happens. Sui’s development activity index is near 38.5, with about 16 daily active contributors. Last year, that number often stayed between 30–40.

Fewer dev contributors can slow new updates but do not mean development has stopped. This trend is common when prices stay under pressure for weeks.

SUI ETF Bets Add a Medium-Term Narrative

While on-chain development continues, a direct spot ETF could open new liquidity for SUI. Canary filed for a dedicated spot SUI ETF on April 8, 2025, with a final SEC decision deadline on December 21, 2025. Bloomberg analysts James Seyffart and Eric Balchunas place the odds of approval at around 60%, based on the current SEC process for commodity-like digital assets.

Meanwhile, Futures open interest for SUI is about $2.05 billion, showing steady trader participation but no new major positions. The funding rate remains close to zero, signaling no big premium for longs or shorts. Liquidation charts show no sudden forced liquidations this week.

This suggests traders are waiting for a clear breakout or breakdown before making bigger bets.

دیدگاهتان را بنویسید