Litecoin (LTC) is starting to attract fresh investor attention after months of underperformance, as the broader market begins positioning around potential regulatory tailwinds.

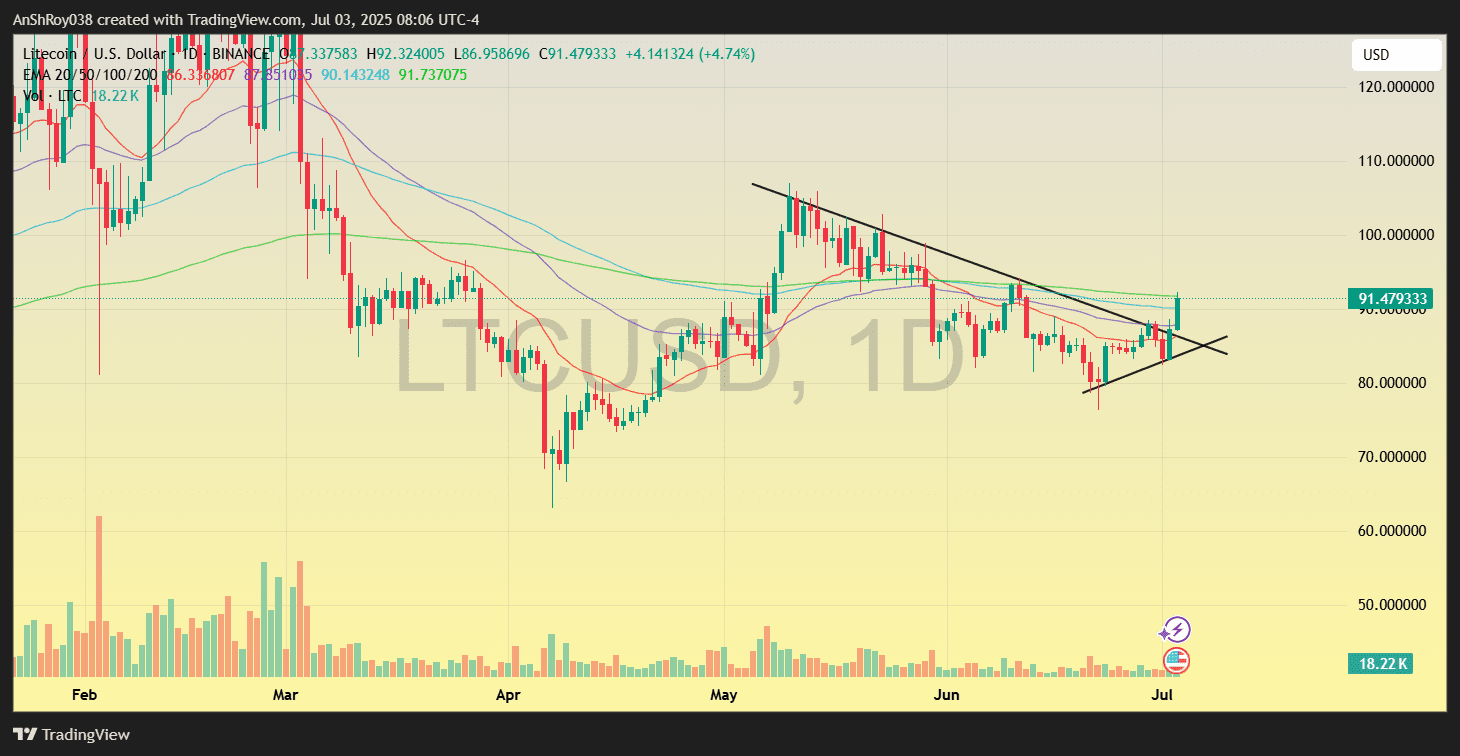

The token rose above $92 on July 3, extending a two-week recovery and reversing a significant portion of its June decline. Moreover, the recent uptrend helped the LTC price move above a multi-week descending trendline, which could help infuse confidence in the token’s price action.

While Bitcoin and Ethereum dominate headlines, LTC’s resurgence has been quieter but increasingly consistent. Rising speculation over a spot Litecoin ETF could be one of the primary drivers, with expectations building for possible U.S. regulatory approval before year-end.

ETF Optimism Sparks Renewed Futures Activity in Litecoin

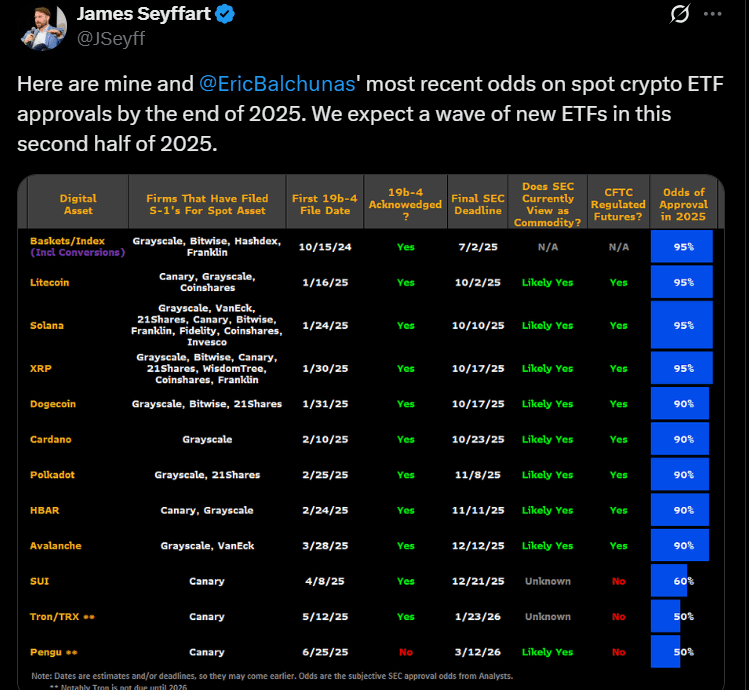

Analysts James Seyffart and Eric Balchunas recently pegged Litecoin’s spot ETF approval odds at 95%, citing regulatory clarity, existing CFTC-regulated futures, and active 19b-4 filings by firms like Grayscale, Canary, and CoinShares.

The final SEC approval deadline is Oct. 2, 2025. Based on derivatives metrics tracked by CoinGlass, this institutional narrative appears to have rekindled speculative interest in LTC derivatives.

Open interest in Litecoin futures rose to nearly $600 million by July 3, steadily climbing from the sub-$450 million levels seen in early June.

The increase coincided with a rebound in LTC price from the $75 range to near $90, suggesting the uptick in OI is not neutral but somewhat directional. Traders are likely positioning ahead of what they perceive as a high-probability ETF catalyst, encouraged by the convergence of legal infrastructure and deadline-based expectations.

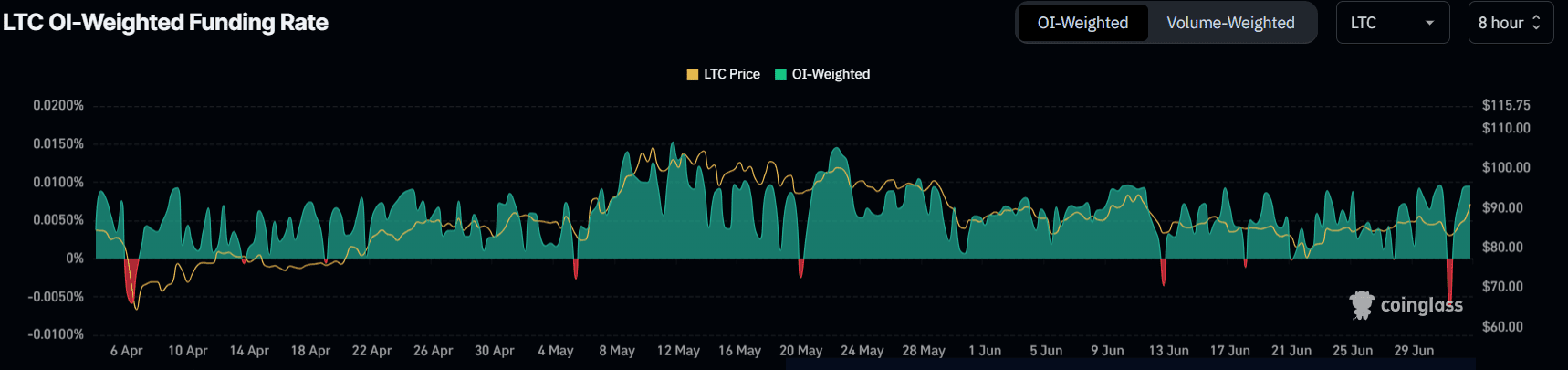

Supporting that view, LTC’s OI-weighted funding rate recently flipped positive after a largely stagnant June. Funding remained flat or mildly negative throughout the past month. It reflected a lack of conviction on both sides of the market. However, the recent rise in price and funding suggests renewed long positioning. It was likely triggered by rising confidence that the ETF narrative is gaining traction.

This alignment of ETF approval odds, rising open interest, and positive funding rates reflects a shift in trader psychology. Speculative capital appears to be re-entering the market, not due to broader bullishness but as a targeted bet on Litecoin’s regulatory tailwind.

Analysts Eye Breakout Setup as LTC Reclaims Key Structure

Litecoin’s latest recovery sparked a wave of bullish commentary from market analysts, who argue that the token’s recent bounce near $84 was a technically significant event rather than a speculative anomaly.

Analyst Marcus Corvinus noted that the $84 support held firmly. It confirmed a high-demand zone that had previously acted as a critical pivot. Corvinus emphasized that LTC’s short-term trend has turned structurally bullish, with upside momentum likely to persist if current volume holds.

Technical validation also comes from visible chart patterns. According to Corvinus’ chart, if bullish pressure sustains, the LTC price could potentially move toward the $110–$140 zone. The LTC USD pair has been moving inside a channel since May, with multiple rejections near a declining trendline. That ceiling has now been breached.

Reinforcing this outlook, analyst Minimilian highlighted a breakout from a diagonal resistance zone visible on the 4-hour timeframe. He argued that Litecoin could quickly retest the $100 level. Minimilian called it a psychological and structural resistance. Beyond that, he hinted at a possible move toward all-time highs if broader market conditions align.

Santolita, another technical analyst, pointed to a triple-bottom reversal setup. He called the formation “loud” and the breakout “inevitable.” His chart showed price coiling just below horizontal resistance near $88, with a projected path targeting $100+ immediately.

Taken together, the bullish case rests on structure, not sentiment. Each analyst backed their thesis with clean pattern recognition and established support zones. While the projections vary slightly in scale, they converge on a common technical message: Litecoin’s recent bounce may mark the beginning of a broader trend shift, not just a reactionary move.

دیدگاهتان را بنویسید