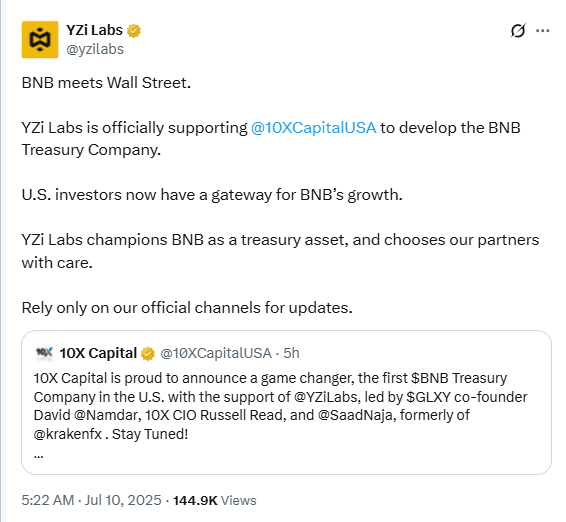

Binance founder Changpeng Zhao (CZ) is backing a BNB treasury firm that plans to go public in the United States. The initiative will be managed by 10X Capital and supported by YZi Labs, according to a statement released on July 10.

The unnamed BNB treasury firm will purchase and hold BNB tokens. It will operate under an asset management model led by David Namdar, a senior partner at 10X Capital and co-founder of Galaxy Digital. Namdar will also serve as the firm’s CEO.

The company plans to list its shares on a major US stock exchange. The goal is to provide institutional exposure to BNB without requiring direct access to crypto wallets or decentralized platforms.

BNB Treasury Firm to Operate Under 10X Capital

10X Capital will act as the asset manager of the BNB treasury firm. The company expects to close its financing round in the coming weeks. It will structure the treasury vehicle in a way that meets US public market requirements.

Ella Zhang, head of YZi Labs, said the BNB Chain is one of the most widely adopted ecosystems. She added that institutional access to BNB token holdings remains limited.

“BNB Chain is one of the most widely adopted blockchain ecosystems,”

said Zhang.

“We believe expanding its institutional access can deliver meaningful benefits to the broader public.”

Hans Thomas, CEO of 10X Capital, said the company wants to provide tools for both retail and institutional investors to gain exposure to BNB.

BNB Token, Binance, and CZ’s Ownership Details

BNB token is a utility token launched by Binance in 2017. It is used on the BNB Chain and offers benefits like trading fee discounts. Although Binance created BNB, the exchange does not control its ongoing development.

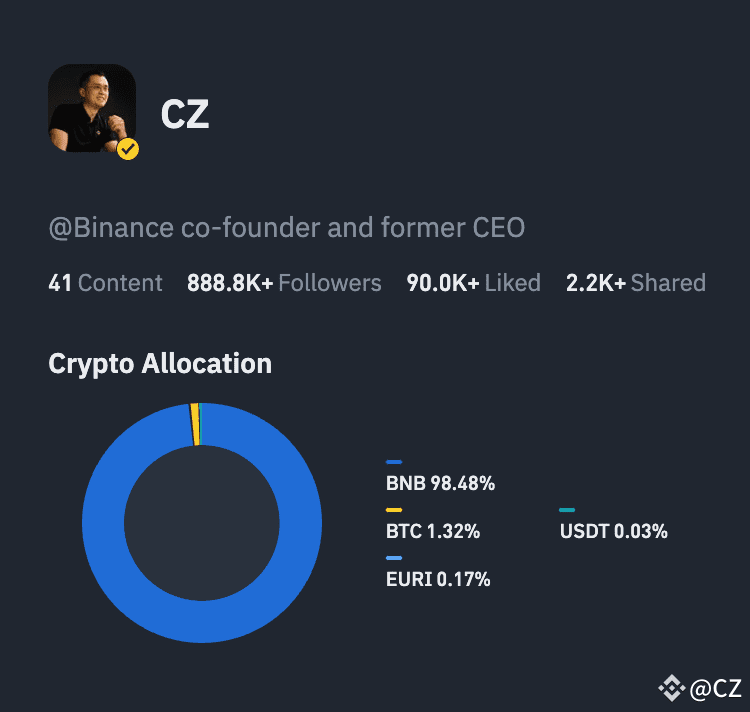

In February 2025, CZ confirmed that 98.5% of his crypto portfolio consists of BNB tokens. He did not disclose the total value. However, Forbes reported in June 2024 that CZ and Binance together control nearly 96% of BNB tokens in circulation.

The report stated that CZ owns 94 million BNB, worth close to $63 billion, or about 64% of the token’s circulating supply. Binance controls 31.5% of the total supply.

CZ stepped down from managing Binance after a plea deal with the US on money laundering charges. He is no longer allowed to oversee the exchange but remains its largest shareholder.

Institutional Exposure to BNB Expands Beyond Binance

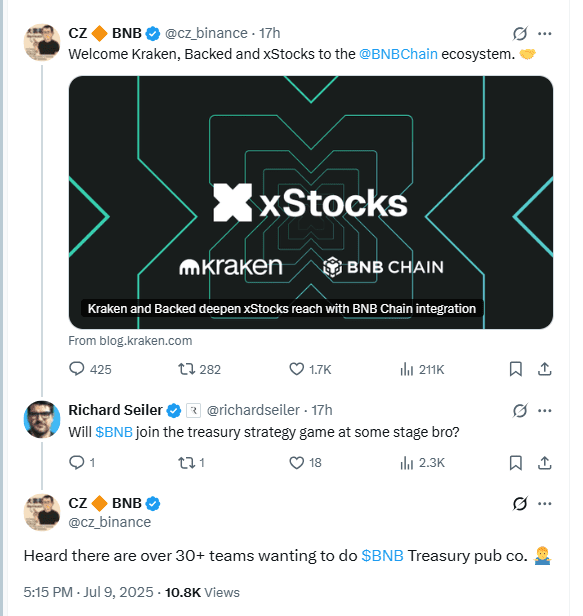

The BNB treasury firm is not the only company focused on holding large quantities of BNB token. Nano Labs, a Nasdaq-listed Chinese chipmaker, said it will purchase up to $1 billion worth of BNB. In early July, it completed a $50 million BNB buy as part of that plan.

Other firms, such as Trident Digital in Singapore and Chinese auto company Webus, have also announced plans to buy and hold altcoins, including XRP.

The trend shows increased interest in altcoin accumulation by public and private companies. On X, CZ stated that more than 30 teams are preparing BNB treasury public companies.

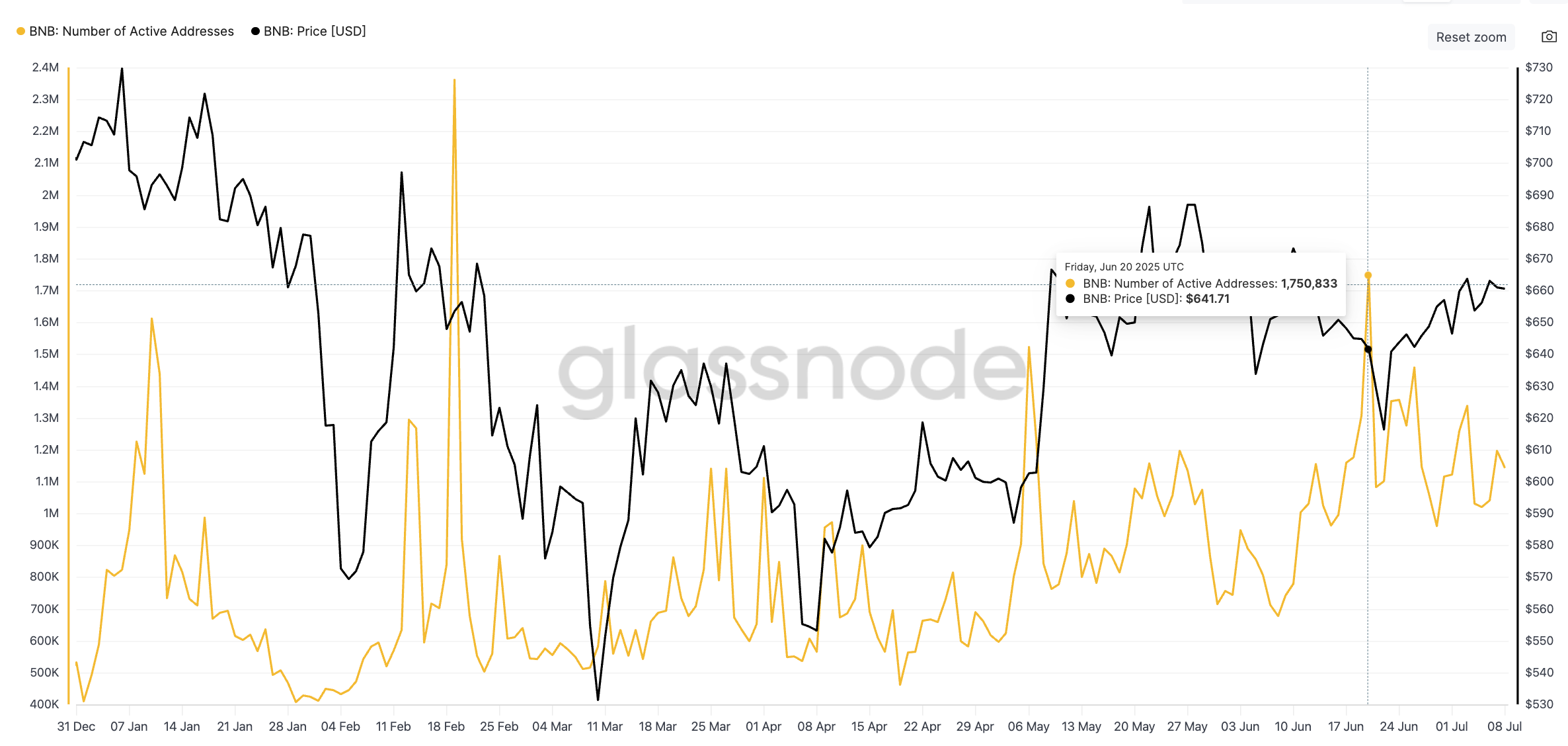

BNB Active Address Count Climbs After Two-Month Decline

BNB’s active address count has increased steadily since early May 2025, following a drop through March and April. According to Glassnode, user participation reached a major milestone on June 20, recording more than 1.75 million active addresses in a single day.

This marked the highest daily count in recent months and reflects a broader return of on-chain activity. While price movement has stayed relatively stable, the rising BNB active address count indicates increased user engagement on the BNB Chain.

Daily address activity often reflects organic usage. Although BNB’s price has moved sideways, the surge in active wallets suggests sustained blockchain usage in the background. This activity includes transfers, contract interactions, and fee payments made using the BNB token.

Top 1% BNB Wallets Increase Holdings in Two Separate Spikes

In parallel, Glassnode data shows a noticeable rise in the percentage of BNB supply held by the top 1% of wallets. On June 21 and again on June 28, these large addresses showed significant accumulation, marking the only two major increases in this metric during 2025.

Before June, top holder activity remained flat for months. These wallets—typically classified as whales or institutional holders—often avoid chasing volatile market moves. Instead, they increase positions during quiet periods.

The “top 1%” BNB wallet metric tracks the total supply held by the largest addresses. A spike in this data often points to accumulation through over-the-counter (OTC) trades or internal redistributions across institutional accounts.

This pattern aligns with the current low-volatility structure seen in BNB price action. While no sharp rallies have taken place, these wallets have steadily built up positions, reflecting a more measured approach.

What Author Thinks About HBAR Price?

BNB Forms Bullish Flag on July 10, Chart Suggests 27% Upside Toward $853 if Breakout Holds

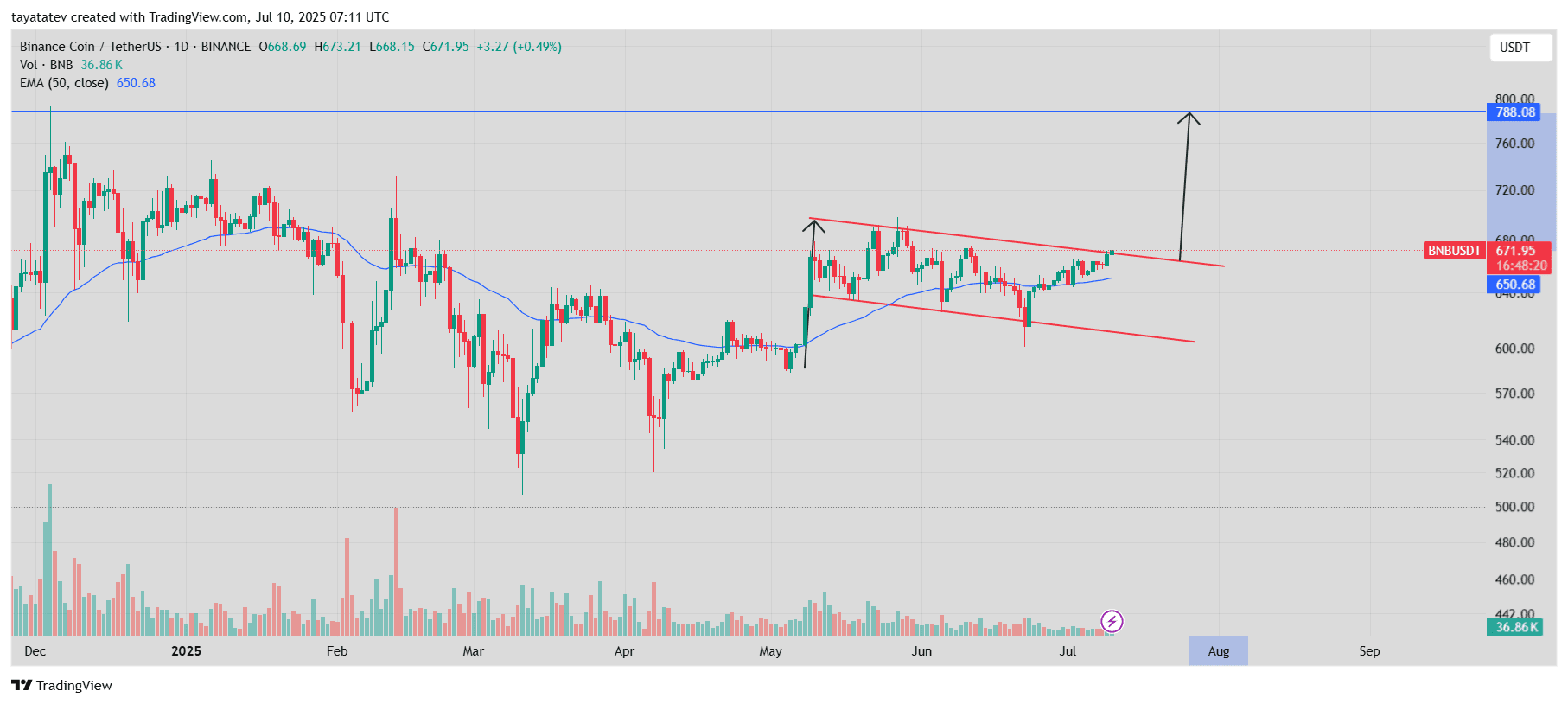

The daily BNB/USDT chart dated July 10, 2025, shows a clear bullish flag pattern, forming after a sharp upward move in April and early May. Since then, the price has moved inside two downward-sloping parallel trendlines, with resistance around $675 and support near $610. This setup, known as a bullish flag, usually appears after a strong rally and is seen as a pause before potential continuation in the same direction.

In this case, the flag follows a steep climb, often referred to as the “flagpole,” and shows gradually declining volume inside the structure, which matches the classic behavior of this pattern. The current BNB price stands around $672, sitting just under the upper trendline.

A bullish flag suggests that if the price breaks above the upper resistance line with strong volume, it could continue its previous rally. The height of the flagpole is about $145, and applying that to the breakout level near $675 gives a projected price of around $853, which is approximately 27% higher than the current value. The 50-day exponential moving average (EMA) at $650.68 has held as support, helping the setup maintain structure.

The breakout hasn’t confirmed yet, but the price is pressing against resistance, and any strong daily close above the flag’s upper boundary may validate the pattern. This would complete the bullish flag and open the way for a larger move to the upside.

دیدگاهتان را بنویسید