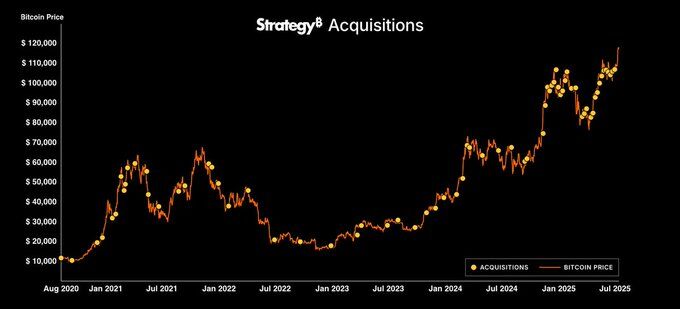

Strategy Bitcoin buy activity restarted on Monday. Michael Saylor signaled the move on X eight hours ago. He wrote, “Some weeks, you don’t just HODL.”

The company paused purchases last week yet arranged a $4.2 billion capital raise. Before the gap, Strategy recorded 12 straight weeks of Bitcoin accumulation.

Its previous transaction occurred on June 30. Strategy bought 4,980 BTC for $532 million. Current BTC holdings total 597,325 coins, worth more than $70.9 billion at the latest market price.

Institutional Demand Outpaces New Supply

Bitcoin treasury companies bought 159,107 BTC in the second quarter. Strategy led that list. Data from BitcoinTreasuries shows institutional demand now exceeds mining output.

Miners create about 450 BTC each day, or roughly 13,500 coins monthly. In contrast, Strategy acquired 379,800 BTC during the last 182 days. That equals 2,087 coins per day.

The miner reserve metric tracked by CryptoQuant keeps falling. This indicator measures all BTC held in miner wallets. Its decline suggests miners are sending more coins to exchanges or treasuries than they retain.

BTC Holdings Lift Share Price Yet Trail Record High

Strategy stock trades near $434. The price is up 16 percent this month but sits below the November 2024 record of $543. The firm remains the largest public holder of Bitcoin accumulation worldwide.

Bitcoin last traded near $118,974. At that valuation, Strategy’s BTC holdings represent a sizable share of circulating supply. Other Bitcoin treasury companies collectively hold almost 3.5 million BTC.

Adam Livingston, author of

“The Great Harvest: AI, Labor, and the Bitcoin Lifeline,”

noted the rapid buying pace. He stated,

“Strategy has accumulated 379,800 in the past 182 days. That’s 2,087 BTC per day — far outpacing the miners.”

Debt Financing Strategy Attracts Scrutiny

Strategy funds many purchases through debt financing and equity sales. The firm disclosed several convertible note offerings since 2020. Proceeds consistently flowed into additional Bitcoin accumulation.

Analysts tracking debt financing instruments say heavy leverage can amplify risk if Bitcoin prices fall sharply. However, public filings indicate the company maintains repayment schedules and interest coverage ratios.

Market participants continue to watch Strategy’s moves because each Strategy Bitcoin buy can tighten liquidity. Large BTC holdings inside corporate treasuries leave fewer coins in daily circulation, adding pressure to spot markets when institutional demand stays high.

دیدگاهتان را بنویسید