Cardano (ADA) has broken above a seven-month descending trendline on the daily timeframe during the recent rally. According to a TradingView update from analyst ScramblerG, the structure mirrors ADA’s historical 285% rally in late 2023, where price surged from $0.25 to $0.96 after a similar breakout. The analyst now projects a possible upside toward $2.76, derived from Fibonacci extensions applied to the current structure.

ADA traded at $0.7527 at press time, up over 3.1% on the day. The price held above former resistance near $0.70, validating the breakout on both price and volume metrics.

Breakout Validated by Volume Surge and Structure Shift

The move out of the descending channel came with rising volume. The total 24-hour volume across exchanges hit $1.31 billion. ADA’s market capitalization has risen to $26.64 billion, placing the token at 10 among cryptocurrencies by market value. This rise in trading activity supports the breakout’s credibility, which ScramblerG identifies as the start of a new impulsive wave.

The Fibonacci extension from the prior swing structure yields a target of $2.76. Intermediate resistance levels from prior cycles are located at $0.8158, $1.0876, $1.3159, and $1.8958, with each representing historical supply zones that could cap the rally if momentum stalls.

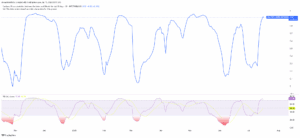

Despite the structural breakout, technical indicators show potential for a short-term pause. The daily Relative Strength Index (RSI) on the ADA to USD pair stands at 73.32, which exceeds the 70 threshold commonly associated with overbought conditions. Historically, such readings often precede consolidation phases or pullbacks, especially near major resistance.

Price structure analysis places the first support zone at $0.66, corresponding with the breakout retest area. The second support zone rests around $0.60, which previously served as a demand cluster during accumulation in early Q2.

ADA/BTC Pair Rebounds From Multi-Month Lows

On the ADA/BTC chart, Cardano has rebounded from a recent low near 0.00000500 BTC and currently trades around 0.00000635 BTC. The RSI on this pair also reads 67.93, suggesting strong relative strength against Bitcoin but nearing the overbought zone. Volume on ADA/BTC has stabilized, with daily trading volume holding around 77.7K ADA.

This relative strength indicates that ADA’s current move is not purely a byproduct of Bitcoin’s rally, but shows evidence of standalone bullish interest.

Additionally, Cardano maintains a 30-day price correlation of 0.92 with Bitcoin (BTC), suggesting that ADA’s breakout may still rely heavily on broader market sentiment. Bitcoin traded at $119,092 at press time, gaining 1.11% in the past 24 hours. BTC’s RSI was recorded at 70.09, suggesting that the leading cryptocurrency is also entering overbought territory.

The high correlation implies that if Bitcoin fails to hold above support around $117,000 to $118,000, ADA’s rally may face invalidation regardless of its own structure. Conversely, continued strength in Bitcoin could provide the environment needed for ADA to pursue its higher resistance targets.

Outlook Aligns With 2024 Rally Fractal, But Pullback Risk Remains

ScramblerG’s analysis aligns the current setup with ADA’s November–December 2024 fractal, where a descending breakout led to a sustained 285% move. The conditions driving that move included a combination of trendline invalidation, rising volume, and supportive macro sentiment—factors that appear again in the present setup.

Still, with RSI on both ADA/USD and ADA/BTC nearing overbought levels and Bitcoin at key resistance, a short-term pullback remains possible. A close below $0.70 could invalidate the breakout and open downside targets at $0.66 or $0.60. On the upside, a daily close above $0.82 could clear the path to $1.08 and beyond.

At press time, Cardano continues to trade above key resistance levels, supported by structure, volume, and correlation. ScramblerG maintains a bullish long-term bias based on historical context but notes that Bitcoin’s trend will remain the deciding factor in ADA’s ability to extend its gains.

دیدگاهتان را بنویسید