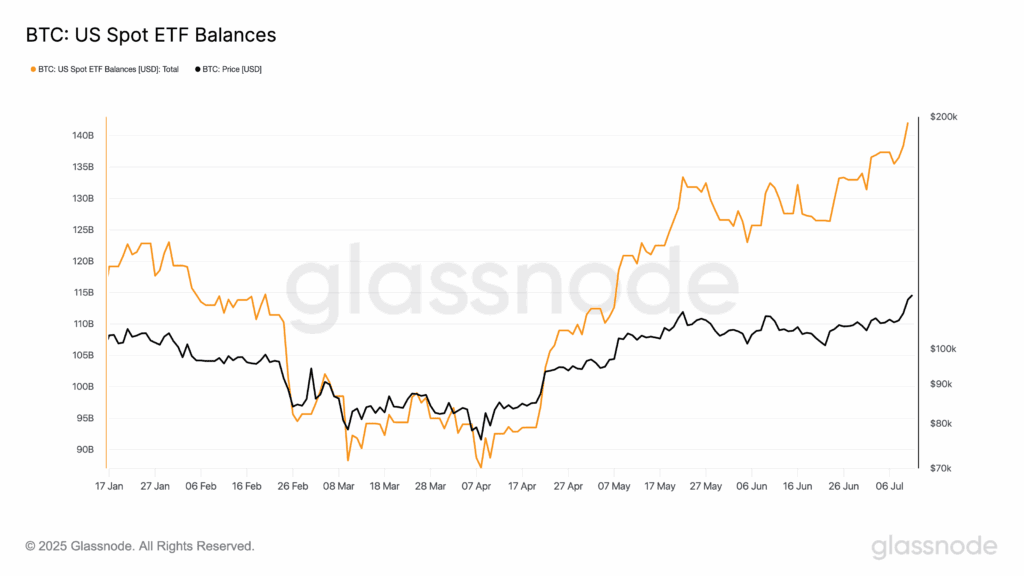

US spot Bitcoin ETFs have now attracted over $140 billion in net inflows since their launch in January 2024, showing strong and sustained interest from institutions. The milestone comes as Bitcoin hit a new all-time high of around $119,000 on July 11, triggering major short liquidations and strengthening bullish sentiment across the market.

BlackRock’s IBIT Leads the Pack

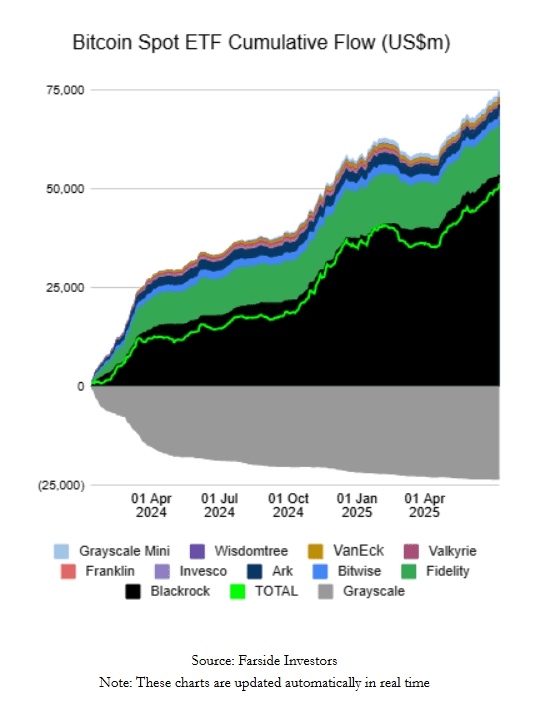

The largest inflow came from BlackRock’s iShares Bitcoin Trust (IBIT), which has pulled in $53 billion, more than the rest of the market combined. Fidelity’s Wise Origin Bitcoin Fund (FBTC) took second place with $12.29 billion in inflows.

By contrast, Grayscale’s Bitcoin Trust (GBTC) is the only fund to face net outflows. Since converting to an ETF, it has lost $23.34 billion in investor assets, likely due to higher fees and increased competition from newer, more efficient products.

BlackRock’s IBIT now holds more than 700,000 BTC, making it the largest single holder among all spot Bitcoin ETFs. It accounts for over 55% of the total BTC held across US-based ETFs. Last week, IBIT reportedly started generating more annual revenue than BlackRock’s flagship S&P 500 ETF (IVV).

The demand isn’t limited to Wall Street. On Monday, Japan-based Metaplanet purchased $237 million worth of Bitcoin, bringing its total holdings to more than 15,500 BTC. This makes it the fifth-largest corporate Bitcoin holder in the world.

Two other firms made similar moves on the same day. France’s Blockchain Group added $12.5 million, while the UK’s Smarter Web Company added $24.3 million to their respective Bitcoin reserves.

Meanwhile, Tokyo-listed firm Remixpoint said it raised $215 million to acquire more BTC, with plans to accumulate up to 3,000 BTC in the near future.

Bitcoin Breaks Record, Ethereum Follows

Bitcoin’s surge to $112,000 triggered more than $200 million in short liquidations over 24 hours, based on derivatives market data. Analysts say the move reflects continued institutional demand combined with aggressive spot buying.

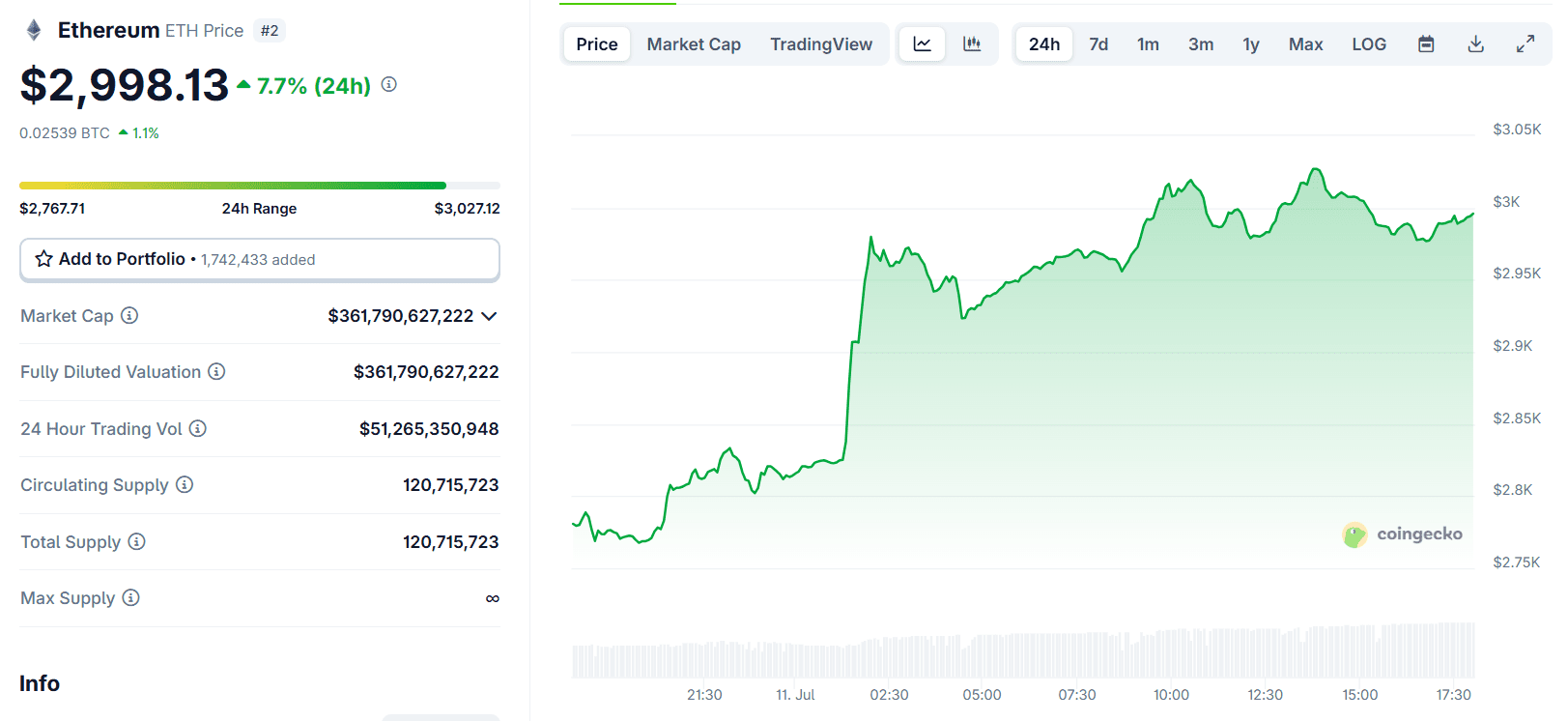

Ethereum has also gained momentum. ETH rose 7.7% in the past day and is now trading around $2,996, according to CoinGecko. Analysts expect ETH to test the $3,000 resistance soon, driven by favorable market structure and positive ETF sentiment.

So far this year, digital asset investment products have brought in $18.96 billion in total net inflows. Bitcoin accounts for 83% of that figure, while Ethereum makes up 16%, per data from CoinShares.

دیدگاهتان را بنویسید