BlockFi’s bankruptcy administrator and the Department of Justice (DOJ) agreed to dismiss a $35 million lawsuit concerning crypto assets held during the company’s bankruptcy. The court officially approved the dismissal on July 11, 2025, according to filings from the U.S. Bankruptcy Court for the District of New Jersey.

The lawsuit, filed in May 2023, involved over $35 million in crypto assets that the DOJ attempted to seize from BlockFi accounts. These accounts were linked to two Estonian citizens charged in a separate criminal fraud case. The DOJ claimed it had valid warrants and demanded the assets be transferred to the U.S. government.

BlockFi’s representatives argued that the bankruptcy court had authority over the funds since they were part of ongoing BlockFi bankruptcy proceedings. The legal dispute delayed final decisions on the handling of those assets.

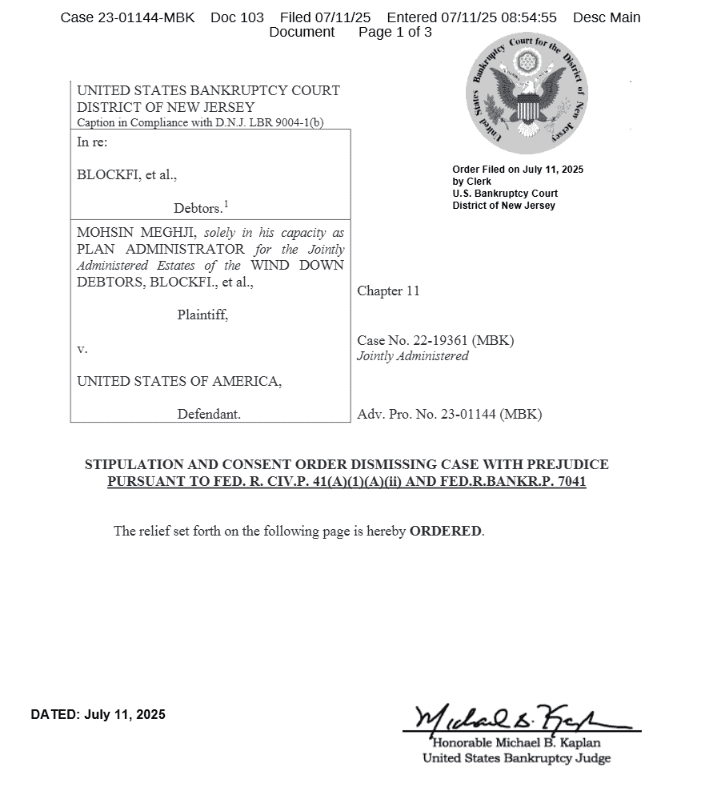

DOJ Crypto Seizure Lawsuit Dismissed With Prejudice

The case was dismissed with prejudice, meaning it cannot be brought back to court. Both the DOJ and BlockFi’s bankruptcy administrator, Mohsin Meghji, agreed that each side would cover its own legal costs.

The DOJ was represented by Seth B. Shapiro, a senior trial attorney from the Civil Division’s Commercial Litigation Branch. The settlement ends nearly a year of legal uncertainty over the funds and removes one of several challenges in the BlockFi bankruptcy process.

The crypto assets in question were not directly linked to BlockFi’s business operations. Instead, the DOJ said the funds belonged to foreign nationals charged in unrelated fraud cases. Still, the assets were held in BlockFi accounts when the company filed for bankruptcy in November 2022.

BlockFi Bankruptcy Plan Clears More Legal Hurdles

BlockFi filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of New Jersey following the collapse of FTX. The court approved BlockFi’s Chapter 11 plan in September 2023, allowing the company to start repaying over 10,000 creditors.

According to court filings, BlockFi owes around $10 billion, including large debts to institutional creditors and the defunct Three Arrows Capital. In March 2024, BlockFi also reached an $875 million settlement with the estates of FTX and Alameda Research. The agreement resolved roughly $1 billion in claims.

During court proceedings, BlockFi CEO Zac Prince stated that actions by FTX founder Sam Bankman-Fried contributed to BlockFi’s collapse. Details of the settlement remain sealed, but the court acknowledged the final figure and confirmed the deal.

BlockFi Coinbase Withdrawals Begin for Eligible Customers

In May 2024, BlockFi began closing its web platform and offered withdrawals through a partnership with Coinbase. The option applied to eligible users with BlockFi Interest Accounts, private client accounts, or retail loans.

The deadline to withdraw assets using the Coinbase partnership was April 28, 2024. BlockFi said this move was part of its wind-down plan approved by the bankruptcy court. After that date, unclaimed funds will follow standard procedures for unclaimed property.

Court filings confirm that many customers withdrew their holdings on time. The dismissal of the BlockFi lawsuit with the DOJ clears one of the final legal challenges tied to asset control.

By removing the risk of DOJ crypto seizure, the administrator can continue focusing on asset distribution and completing the BlockFi bankruptcy process without interference from outside seizure efforts.

دیدگاهتان را بنویسید