Exploring Promising Crypto Projects: AurealOne and DexBoss

Current investors face numerous challenges to select the right crypto opportunities due to the high number of regularly launched projects in the market. Investors should monitor the progress of AurealOne and DexBoss since both projects show potential. Active investors can currently benefit from acquiring tokens at lower prices through pre-sale phases of these projects. This article examines two crypto projects because of their rising popularity in the market.

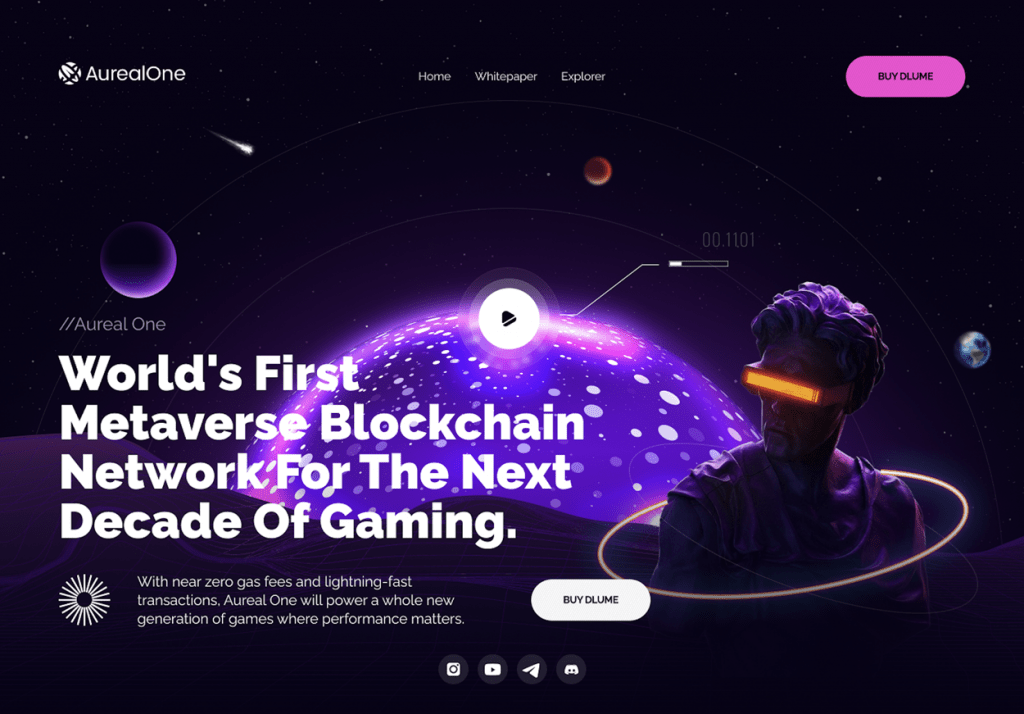

AurealOne: Revolutionizing Blockchain Gaming

AurealOne was developed to fulfill the unique requirements within the gaming space as well as the metaverse domain. The alenetwork AurealOne delivers blazing transaction speeds alongside minimal expenses for operating costs which transforms it into a suitable solution for immediate gameplay and digital asset trades. AurealOne reaches its performance goals through Zero-Knowledge Rollups which scales the network without diminishing security levels.

The Role of DLUME Token

DLUME token serves as the central economic value within AurealOne. The platform token DLUME functions as both payment method in gameplay and stake mechanism and democratic governance system. The DLUME token inherits its utility from being staked by users for both reward earnings and decision-making power on platform development through governance participation. DLUME token functions across multiple games on the network and deepens its presence as essential core platform functionality.

AurealOne’s Pre-Sale Strategy

The pre-sale of AurealOne spans twenty-one deals that raise the price rate from $0.0005 to $0.0045. AurealOne’s pre-sale attempt targets a total of $50 million while it provides bigger token allocations to early participants to improve their motivation. The funding strategy uses a specific pricing schedule that simultaneously pays for project expenses and encourages initial support allocations. The value of DLUME tokens will increase as more users and developers join the platform as it continues to grow.

Clash of Tiles: A Sneak Peek into AurealOne’s Potential

AurealOne’s flagship game, Clash of Tiles, serves as a proof of concept for the platform’s capabilities. Through Clash of Tiles the game shows how AurealOne provides technological support for interactive blockchain-based gameplay. AurealOne introduced its flagship game which starts the development of a bigger digital universe through multiple gaming projects that expand the AurealOne ecosystem.

DexBoss: Simplifying DeFi with Cutting-Edge Features

DexBoss develops tools through which decentralized finance (DeFi) becomes available to users who may not have extensive experience with crypto markets. The platform provides utilization of a user-friendly interface which functions for traders with different skill levels. DexBoss provides users with margin trading alongside liquidity farming and premium liquidity pool access to maximize their investments in a straightforward way through DeFi.

The Power of $DEBO Token

The DexBoss platform functions through the core element of the $DEBO token. The $DEBO token serves to stake platform resources as well as affords governance responsibilities and earns rewards from liquidity pools thereby granting owners ownership benefits in community growth. DexBoss tokenomics combines with methods to maintain sustainability while giving initial participants financial benefits. The $DEBO token functions as both a transaction enabler and as a platform basic that lets users interact with finite financial features.

DexBoss’s Pre-Sale Phases

The 17 rounds of $DEBO pre-sale begins at $0.01 before moving progressively to $0.0505. The platform has established tactics to disperse tokens totaling $50 million through a format that supports the enduring development of the platform. Through a structured early sale investors enjoy reduced pricing during periods that teach them increased platform value as the platform develops.

Innovative DeFi Tools and Features

The trading interface at DexBoss enables users to access deep liquidity pools in addition to margin trading and farming features. The platform offers tools which enable users to boost their returns making it suitable for capitalizing on DeFi market growth opportunities. DexBoss provides swift operations paired with potent assistance to support users at different skill levels within the DeFi domain.

Why These Projects Could Be the Next Big Thing

The blend of gaming and metaverse specialization at AurealOne matches exactly the main growth sectors of blockchain technology. The future of digital entertainment will receive considerable shape from AurealOne’s platform because both the metaverse sector and gaming industry continue their growth trajectory.

DexBoss, with its intuitive platform and DeFi-focused tools, offers a comprehensive solution for crypto traders and investors. The simplified DeFi approach of DexBoss positions the project at the forefront of its marketplace to attract both novices and professionals.

Final Thoughts: Are AurealOne and DexBoss Worth Investing In?

The most exciting crypto assets that are available in pre-sale status are AurealOne and DexBoss. These platforms demonstrate promising prospects because they have solid tokenomics together with well-defined value propositions and aimed towards increasing user involvement. The ongoing expansion of these projects makes them promising competitors that could dominate their individual sectors—gaming and DeFi. Both projects possess growth potential which may enable them to compete with popular cryptocurrencies such as Bitcoin.

However, the crypto landscape is extremely volatile. So, investors must proceed with caution.

Disclaimer: The views and opinions presented in this article do not necessarily reflect the views of CoinCheckup. The content of this article should not be considered as investment advice. Always do your own research before deciding to buy, sell or transfer any crypto assets. Past returns do not always guarantee future profits.