With Ripple (XRP) buyers beginning to realize their gains after a 330 percent annual outburst, those are set to start focusing on cheaper and more leveraged tokens. Among the projects attracting attention, one can distinguish $LILPEPE, a meme coin with ambitious blockchain plans to be spawned by the frog culture. With the support of a Layer 2 network that could offer cheap gas fees and scalability, it is not true that the Little Pepe ($LILPEPE) is just jumping around to have some fun but developing a decentralized community. An amount of over a quarter of the entire 100 billion tokens it has issued, at a precise split of 26.5% of tokens issued, will be reserved during this early phase to provide a sense of urgency to those in the early investing stage.

Lightning-speed presale: 550K to $1.85M in days

It took the project $LILPEPE only three days to raise half a million dollars, which is one of the first indicators of the demand increase in alternatives to the high-cap tokens. The frog is not only a meme but also a glimpse into the potential DeFi participant as far as investors are concerned.

Today, having raised more than $1.85 million, Little Pepe has come into the limelight during its presale. The meme coin sold out Stage 1 at $0.001 by raising $500,000 and selling 500 million tokens in just 72 hours. Stage 2, priced at $0.0011, sold 1.167 billion tokens, raising $1.325 million ahead of schedule. It is now in Stage 3, where tokens are priced at $0.0012, and so far, over 1.6 billion tokens have been sold. The next stage will increase the price to $0.0013, with a final listing price expected at $0.003—offering early participants a potential 2.5x gain before launch.

Behind this advancement is the fact that it has a native Layer 2 blockchain capable of minimal fees per transaction and high scalability. The tokenomics are well designed: 30% is set aside to support the ecosystem, 10% goes to liquidity, 10% goes to marketing, and 13.5% goes to staking and community rewards. Fueling additional excitement is a $777,000 giveaway, where 10 winners will each receive $77,000 worth of LILPEPE tokens, further boosting visibility and community engagement across social media.

Ripple calms down after going up, as $LILPEPE heats up

The crypto XRP of Ripple has been enjoying a tear with a 330 percent surge in 12 months, or nearly $0.30 a year ago to over $1.29 at present, but a hint of fatigue has been noticed. With the technical resistance getting close and profit-taking bids having surged, the latest entries, such as $LILPEPE, are scaling to attractive alternatives to XRP. In comparison with XRP, which is under a high degree of resistance around the price range of $1.30 to $1.40, $LILPEPE is currently at the cheapest and most exploitative stage of pricing. The meme coin started with the price of a mere $0.000000012, and its first tier is already sold out.

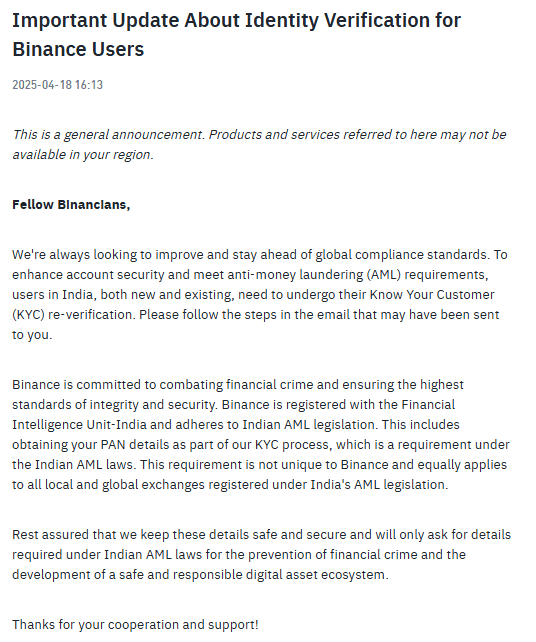

XRP 1w-chart showing price action | Source: X

Weekly buy-ins are increasing continuously, and the weekly count of wallet activity rises upwards every month—the implication of the same is that $LILPEPE might be able to replace the needs of speculation by some frost giants like XRP.

LILPEPE goes beyond memes: Ecosystem, rewards, and a $777K giveaway

The spirit of internet humor does not pass through the shell of $LILPEPE though, its infrastructure is no laughing matter. Having 13.5 percent of its supply available to be staked and received by the community rewards, it is obvious that this team is not making a short-term hype project.

The holders will be able to stake their tokens in the near future to generate passive income, take part in the governance, and contribute to the work of the network. And it is not the purchasing only, but a free promotion campaign is also going on. Lucky winners will participate in getting free $LILPEPE tokens, which will attract attention in Telegram and X (previously Twitter). Have you recently won some of these Little Pepe prizes? Many people have come in, and after the last presale point, the professionals will announce the winners. With its last token allocations just around the corner and DEX/CEX listings in the process, the LILPEPE is looking to be more than a meme, as it is an entire crypto movement geared towards people willing to jump ahead.

For More Details About Little PEPE, Visit The Below Link:

Disclaimer: This is a sponsored article. The views and opinions presented in this article do not necessarily reflect the views of CoinCheckup. The content of this article should not be considered as investment advice. Always do your own research before deciding to buy, sell or transfer any crypto assets.