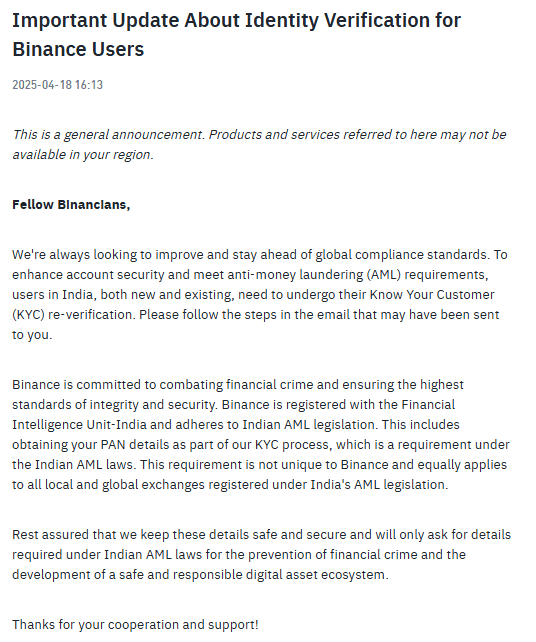

YEREVAN (CoinChapter.com) — Binance introduced a mandatory KYC re-verification process for all Indian users. This includes both current and new users. They must now update their details and link their Permanent Account Number (PAN).

The company shared the update on April 18. In a post on X, Binance said,

“Users in India may need to re-verify their KYC details, including linking their PAN.”

This rule applies under India’s anti-money laundering (AML) law.

The PAN is a 10-digit alphanumeric ID issued by the Income Tax Department. It is used for tax reporting and financial transactions. Binance stated this step is required by Indian law and is not exclusive to its platform.

FIU Binance India Fine Reached ₹188.2M in 2024

India’s Financial Intelligence Unit (FIU) fined Binance ₹188.2 million in 2024. The fine equaled around $2.2 million. Authorities said Binance failed to meet AML rules. As part of that enforcement, India also asked Apple to remove the Binance app from its App Store.

Following this, Binance registered with the FIU. Since then, it has introduced new compliance steps, including this Binance India KYC re-verification.

The company said user information will only be collected for legal compliance. According to its statement, Binance India KYC updates will not include data beyond what is needed under the AML law.

As part of the Binance KYC update, all Indian users must now link their PAN card. This rule applies to both new and existing accounts. Without this, users may face restrictions.

The PAN helps the government track financial activity, including cryptocurrency transactions. The new Binance India KYC requirement aims to align the exchange with India’s financial laws.

Binance emphasized that this requirement is not unique. All crypto firms operating in India must follow the same regulations. The platform clarified this in its statement on X and through official channels.

Crypto TDS India Investigation Targets Binance Users

The Economic Times reported that India’s Income Tax Department is investigating some Binance users. Authorities want to know if traders used the platform to avoid the 1% Tax Deducted at Source (TDS).

By law, crypto traders in India must either pay TDS or show documents proving exemption. Regulators are checking if Binance allowed users to bypass this rule.

India has increased its focus on crypto TDS enforcement. This includes monitoring foreign platforms like Binance. The ongoing Binance KYC update is part of the response to that scrutiny.

Binance said the update supports national AML goals. India crypto regulation now applies to both domestic and foreign platforms. This includes Binance and other global firms registered under Indian law.

The Binance AML fine in 2024 triggered stricter rules for the exchange. Since then, Binance has worked to stay active in India while meeting regulatory conditions.