Playing at online casinos and gambling with cryptocurrencies has become hugely popular in recent years. However, many players are wary of sharing personal information due to increasing KYC/AML regulations. If you want to gamble anonymously without verifying your identity, crypto casinos that don’t require KYC are the way to go.

In this in-depth guide, we’ll explore the best anonymous crypto-gambling sites in 2025. All of these casinos let you play without submitting documents like ID, proof-of-address, or bank statements. We’ll give a thorough overview of each platform, including game selection, bonuses, payment options, and more. By the end, you’ll know which no-KYC casinos are perfect for your anonymous gambling needs.

The best anonymous casinos in 2025:

- Betpanda – Modern crypto casino with no KYC requirements

- 7Bit Casino – Top-rated no-KYC casino featuring Bitcoin and altcoins

- Cryptorino – 6,000+ games, no forced KYC, up to $500 in free sports bets every week

- WSM Casino – All-in-one crypto sportsbook and casino with no ID verification

- BC.Game – Popular no-KYC Bitcoin casino with over 3,000 games

- Playbet.io – New no-KYC crypto casino boasting massive bonuses and large game selection

- JustBit – No-frills crypto casino delivering on the fundamentals without KYC

- Bitcasino – Veteran anonymous crypto casino known for big jackpots and Bitcoin sports betting

- Bitstarz – Established crypto casino famous for its generous rewards program

What to consider in a no-KYC crypto casino

When choosing an anonymous online casino, there are a few important factors to keep in mind:

- Game selection – Ensure your chosen casino offers your favorite casino games without any limitations due to anonymity. Sites with a big game library maximize your playing options.

- Bonuses and rewards – No-KYC casinos still offer engaging welcome packages and loyalty programs. Check the bonus terms to see their value.

- Supported cryptos – Anonymity works best with privacy-centric coins like Monero.

- Reputation – An anonymous casino needs a solid track record of safe, fair, and quick financial services. Read verified player reviews.

- Security – SSL encryption and proper licensing reassure users that funds and personal data remain fully protected.

9 top no-KYC crypto casinos to gamble anonymously in 2025

Now, let’s explore the top no-KYC crypto casinos for anonymous gambling in 2025. For each entry, we’ve included a description and briefly outlined the pros and cons.

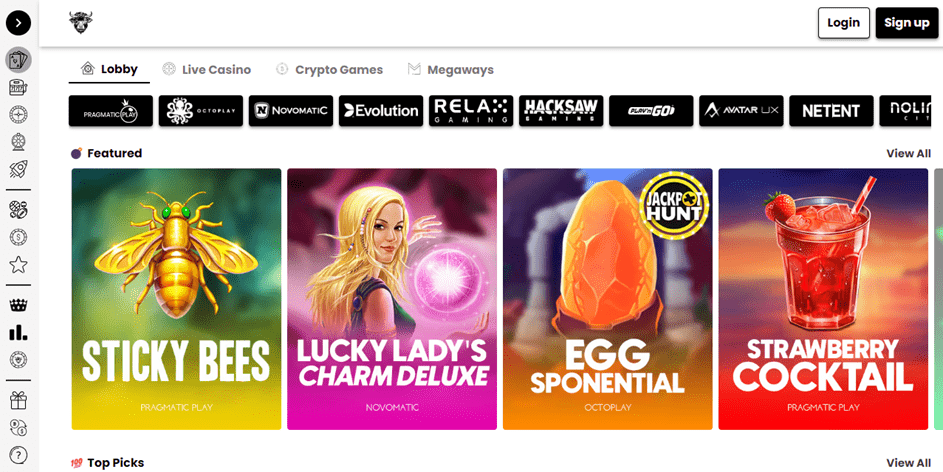

1. Betpanda – Modern crypto casino with no KYC requirements

Betpanda is a relatively new cryptocurrency casino that offers a great belnd of exciting casino games, sports betting options, and an attractive promotional program that rewards both new players and returning ones.

The site boats a very low minimum deposit limit of just 10 cents, which means that virtually anyone is capable of depositing and using the casino. On top of that, Betpanda users can look forward to a 10% cashback when playing their favorite games (with 5% extra reserved for select titles).

The casino features more than 6,000 games from some of the leading providers in the casino space, which is definetly a nice pro, however, we would have liked to see a more extended support of cryptos, and support for fiat deposits would also be welcome. But the support for fiat clashes with the KYC requirements, which means that most users who don’t want to share their personal information would not use fiat methods in any case, so it’s hard to criticize the casino for their decision.

Pros

- Over 6,000 games from leading providers

- Supports betting on all major sports events

- Modern and sleek user interface

Cons

- Somewhat lackluster Welcome Bonus compared to competitors

- Limited support for different cryptos

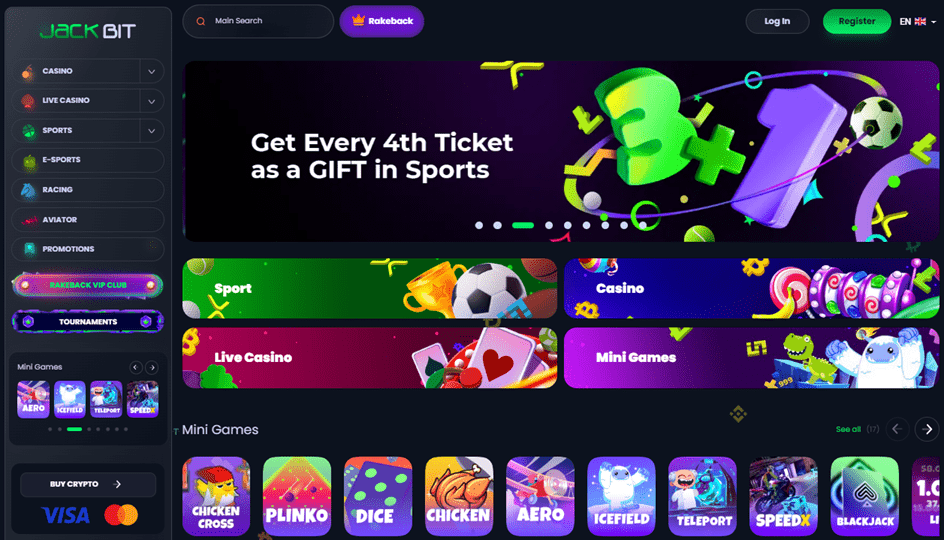

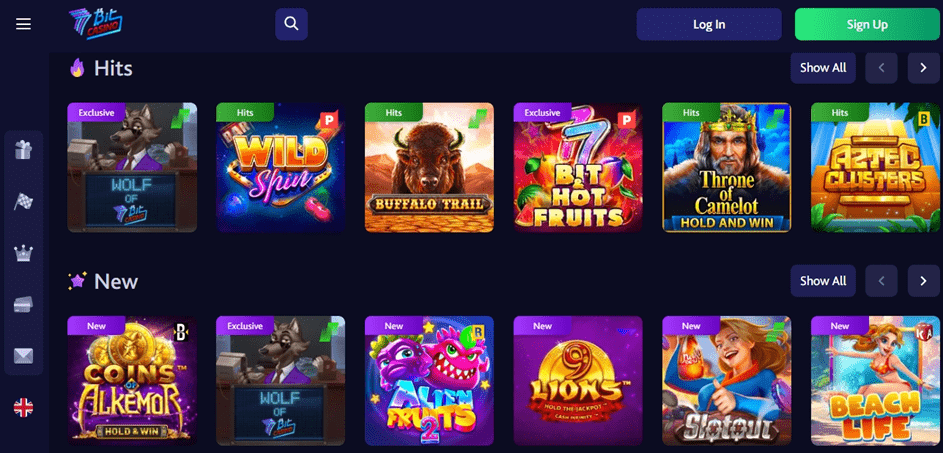

2. 7Bit Casino – Established favorite for its generous promotions

Another top choice is 7Bit Casino. Here you can play over 800 games from 30+ providers like NetEnt, Microgaming, and Play’n Go.

7Bit offers a 100% four-part welcome bonus as well as 250 no-wagering free spins just for signing up. On top of that, you don’t even need to deposit to claim 75 spins as an additional no-deposit gift. Other perks include daily 25 free spins, a jackpot of 25 BTC, and anonymous ETH transactions.

7Bit has one of the best no deposit crypto casino bonuses, competing with industry leaders like Bitstarz, and FortuneJack.

7Bit is well designed with seamless experiences across desktop and mobile. You can indulge your passion for slots, table classics or live dealer options and claim generous bonuses anonymously with no identity check. Don’t forget to take advantage of the free 75 spins on registration!

Pros:

- Great bonuses

- Huge game selection

- Fast withdrawals

Cons:

- Must submit basic details to access full site features

- Restriction for some certain locations

- Withdrawal requests limits

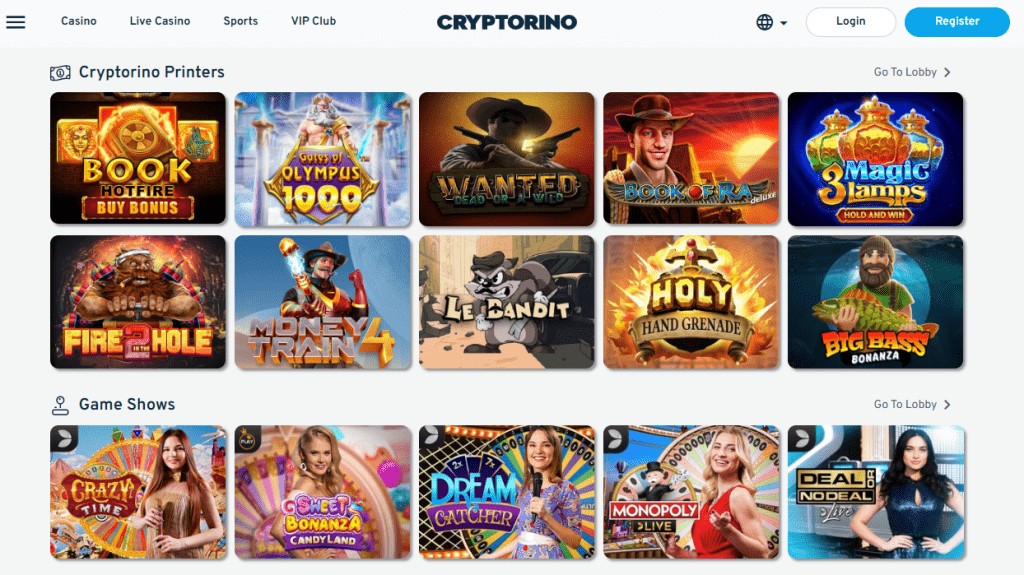

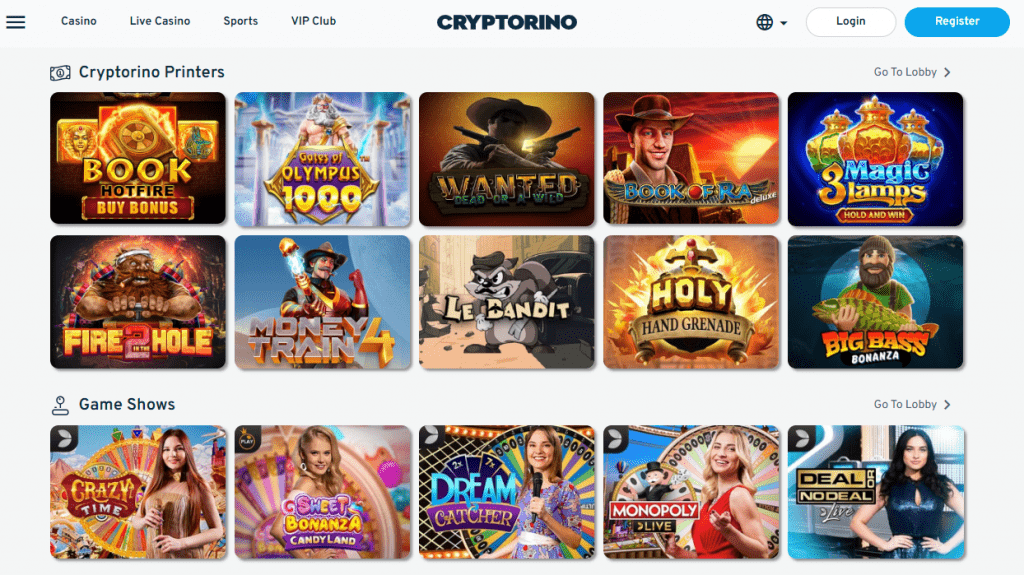

3. Cryptorino – Anonymous crypto gambling with sports freebets and 6,000+ games

Cryptorino is a privacy-friendly crypto casino that lets you gamble without submitting any personal documents, as long as you stick to cryptocurrency payments. With over 6,000 games — including slots, jackpots, live casino, and table games — it offers one of the most comprehensive gaming libraries among no-KYC platforms. It also features a full sportsbook and esports betting section, covering markets in football, MMA, Dota 2, Valorant, and more. Cryptorino supports a broad range of coins such as BTC, ETH, DOGE, SHIB, LTC, and stablecoins like USDT, alongside fiat payments (though KYC-free gameplay applies only to crypto).

The casino’s 100% welcome bonus up to 1 BTC is paired with 10% weekly cashback and a freebet system that grants up to $500 every Thursday based on sports betting losses. These promotions are strong incentives, though the 80x wagering requirement with a 7-day limit on the bonus may be too steep for casual players. Still, for gamblers seeking a large game selection, regular promos, and fast anonymous play, Cryptorino is a solid new entry in the no-KYC gambling space.

Pros:

- 6,000+ games across slots, live casino, and table games

- Integrated sportsbook and esports betting

- No ID verification required for crypto play

- Weekly 10% cashback and up to $500 in free sports bets

- Wide crypto support, including DOGE, SHIB, and USDT

Cons:

- High 80x wagering on welcome bonus

- Bonus must be completed within 7 days

- No mobile app

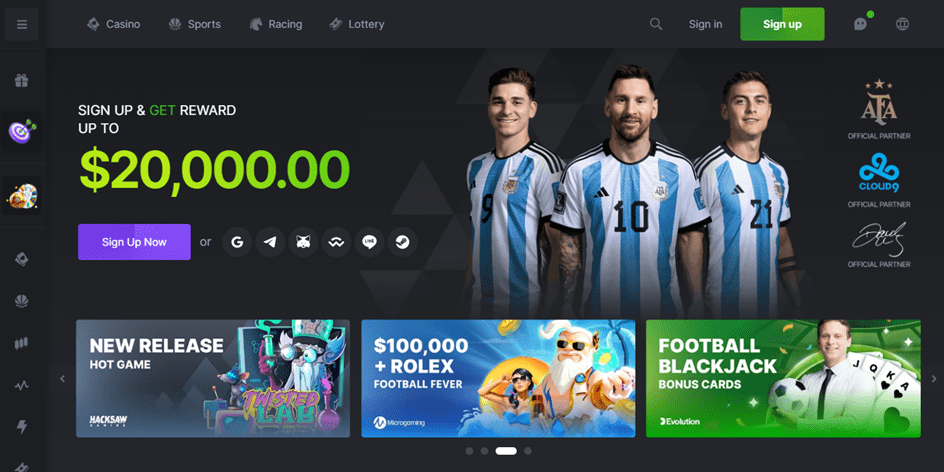

4. WSM Casino – New upstart gunning for the crypto gambling crown

For crypto sports betting fans, WSM Casino is an excellent anonymous option. It provides odds on eSports, traditional sports, and even reality TV outcomes. You’ll find coverage of Premier League, NBA, Dota 2, League of Legends and more.

As reviewed on CoinCheckup, WSM’s welcome offer gives a 200% match on deposits up to $12,500 or equivalent in crypto. On registration, claim 50 no-wagering spins plus 10 free bets to use on available markets.

For high rollers, the VIP program dishes out personal account managers, exclusive events, and a cashback of up to 20% weekly based on wagering. WSM is a Bitcoin sportsbook that takes online betting to the next level anonymously.

Pros:

- Fun environment

- Generous sign-up deals

- 24/7 live customer support

Cons:

- Smaller game provider selection compared to competitors

- No dedicated mobile apps

- There is no VIP program

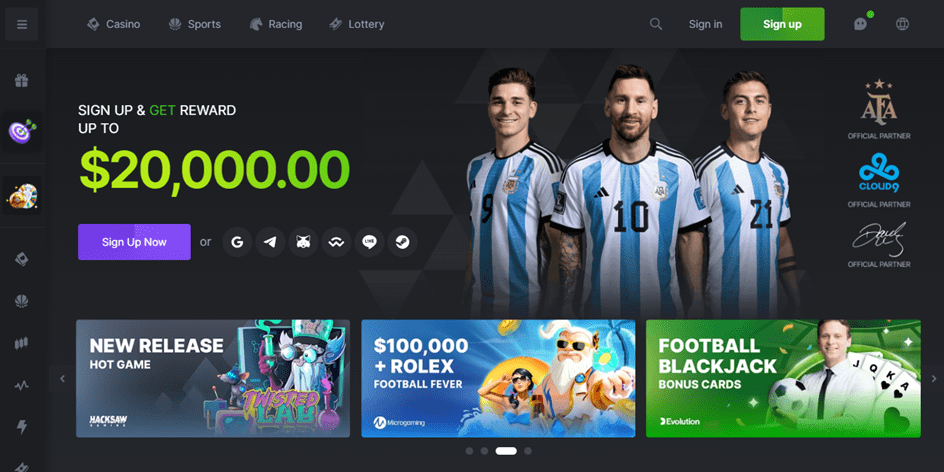

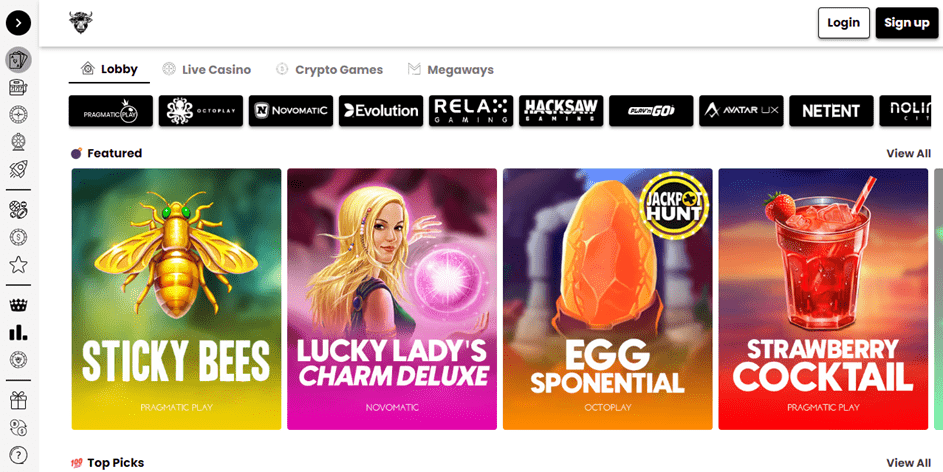

5. BC.Game – One of the original crypto-only casinos

BC.Game is one of the most established crypto casinos worldwide with no need for documents. Launched in 2017, it offers a huge 360% four-part welcome package along with numerous daily spin and task bonuses. BC.Game accepts over 25 cryptocurrencies while keeping transactions fully private.

Besides the 360% first deposit offer, new players get 100 free spins as part of the welcome gift. Existing users can grab 30 daily free spins just for logging in each day. BC.Game provides truly anonymous crypto gambling without compromising on games, features, or bonuses.

Pros:

- Huge welcome package

- 24/7 support via live chat and email

- Jackpots, live dealer tables, video poker, and 3000+ slot games

Cons:

- The interface feels a bit outdated

- Bonuses have high wagering requirements

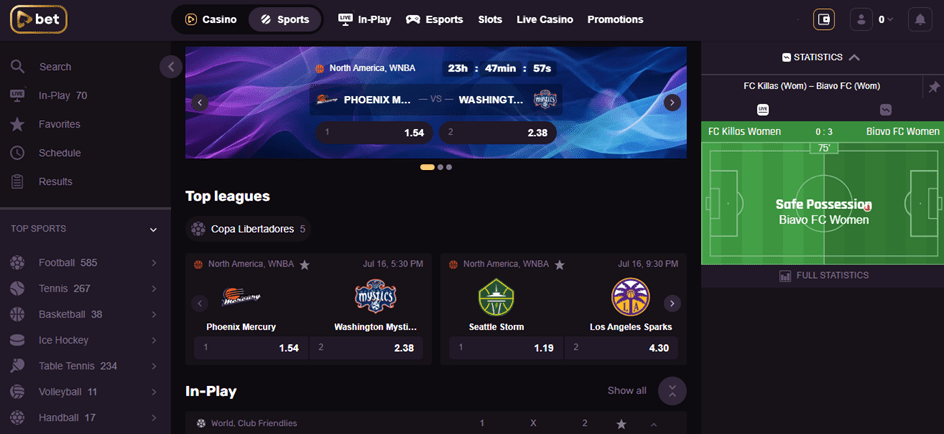

6. Playbet.io – Sleek interface attracting live dealer enthusiasts

Established players will love the welcoming offers at Playbet.io. It provides a tempting 130% matched bonus across four deposits worth up to 4 BTC total.

Additionally, Playbet gives 800 no-wager spins across all four sign-up gifts. Cryptocurrency transactions proceed smoothly with maincoins like Bitcoin, Dogecoin, and Ethereum.

In terms of games, Playbet stands out with 4000+ slots, jackpots, table games, and live casinos. You can spin reels on the go using their optimized mobile site too. Playbet offers generous bonuses to kickstart anonymous crypto gambling.

Pros:

- Huge welcome package for high-stakes players

- Epic free spins offer

- Great VIP experience

Cons:

- The interface feels a bit dated

- No mobile applications

- Limited customer support

7. JustBit – High roller site with good bonuses but limited games

With multiple positive reviews to its name, JustBit provides a 100% three-part welcome offer worth $750 total. Aside from the signup bonus, you’ll receive 75 free spins with no wagering obligations.

This anonymous crypto casino trades only in cryptocurrencies like Bitcoin, Ethereum, and Tether. Over 2000 games span slots from NetEnt, Play’n Go, and Betsoft. JustBit ensures fast BTC withdrawals and a modern interface. Give it a try without worries about mandatory ID verification.

Pros:

- Friendly vibe

- Generous no-brainer bonuses for new players

- Mobile apps available

- Users can buy crypto on the website

Cons:

- Game selection is not as extensive as larger competitors

- Lack of user navigation

8. Bitcasino – Long-running crypto casino best known for the generous first deposit bonus

As a top-rated no-KYC crypto casino, Bitcasino offers a generous 100% matched bonus of up to $1,500 on the first deposit.

This invite-only gaming platform accepts Bitcoin and supports anonymous transactions. Access to 3000+ top-tier slots, jackpots, and table games from leading providers. Bitcasino also runs exclusive tournaments where you can compete to win huge Bitcoin prizes.

Pros:

- Established brand

- Excellent security and safety track record

- 7/24 Live chat customer support

- Mobile app for Android users

Cons:

- Welcome bonus structure could be more competitive

- Limited poker games

- Limited deposit options

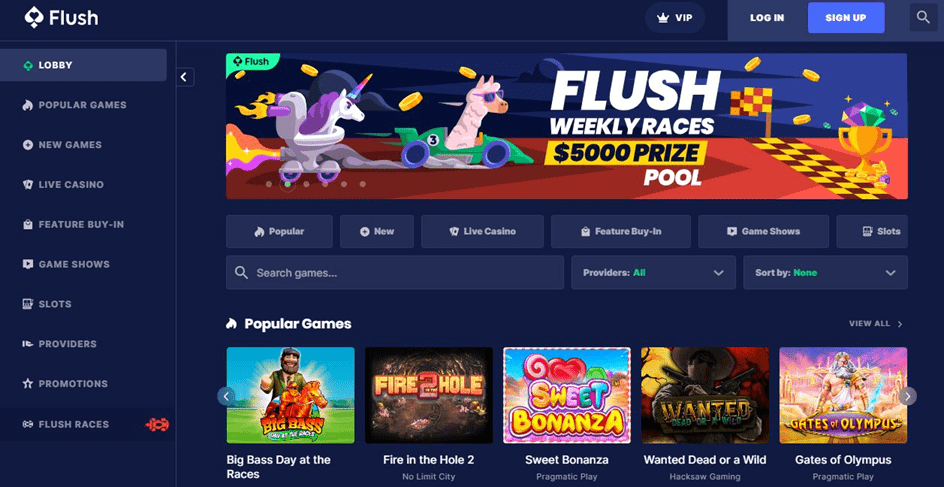

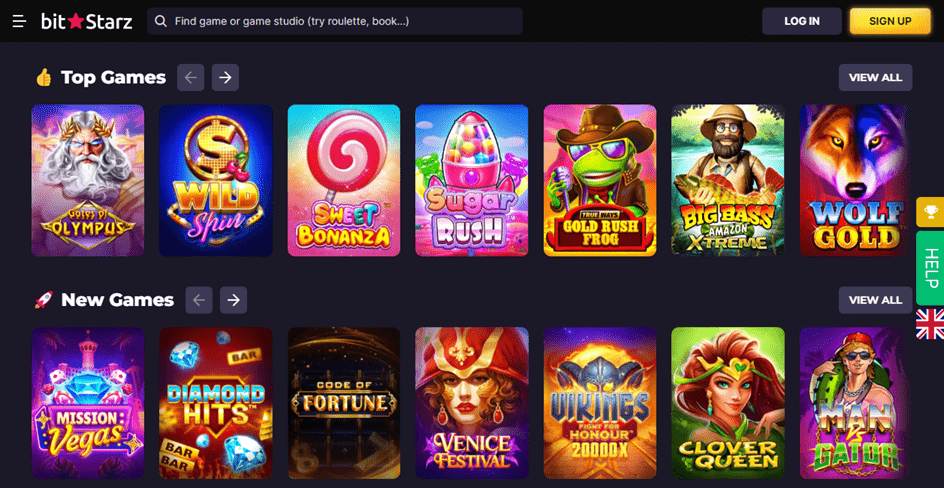

9. Bitstarz – Long-running favorite for its lively casino atmosphere

Established in 2014, Bitstarz was one of the pioneering crypto casinos. Even today, it remains massively popular due to a massive 125% first deposit matched up to 5 BTC.

As per CoinCheckup, Bitstarz gives 190 no-wager spins on second, third, and fourth deposits too. For joining, receive 30 additional free spins with zero playthrough requirements.

The site boasts 4000+ slots, board games, jackpots, and live casinos from leading developers. Deposit and withdrawal are fast using Bitcoin, Ethereum, or fiat. Bitstarz remains unparalleled for massive bonuses without submitting personal details.

Pros:

- Established brand

- Very generous sign-up bonuses

- Quick response on live chat

Cons:

- Only accepts 7 cryptocurrencies for deposits/withdrawals

- Limited game selection

The bottom line

These crypto casinos provide anonymous gambling experiences seamlessly without identity checks. Choose one based on your location, preferred games, and signup bonuses to start crypto gambling privately today. For more information, you can check the best crypto casinos with generous no deposit bonuses for slots, including 7Bit Casino, Flush Casino, and more top-rated sites.