YEREVAN (CoinChapter.com) — Dogecoin holders marked April 20 as “Dogeday,” an unofficial community event tied to the token’s meme origins. The celebration started in 2021 during International Weed Day and gained popularity among Dogecoin supporters.

Dogecoin holders now connect the day with significant developments. This year, attention focuses on the approaching decisions by the U.S. Securities and Exchange Commission (SEC) on several Dogecoin ETF filings. The timing adds weight to this year’s Dogeday.

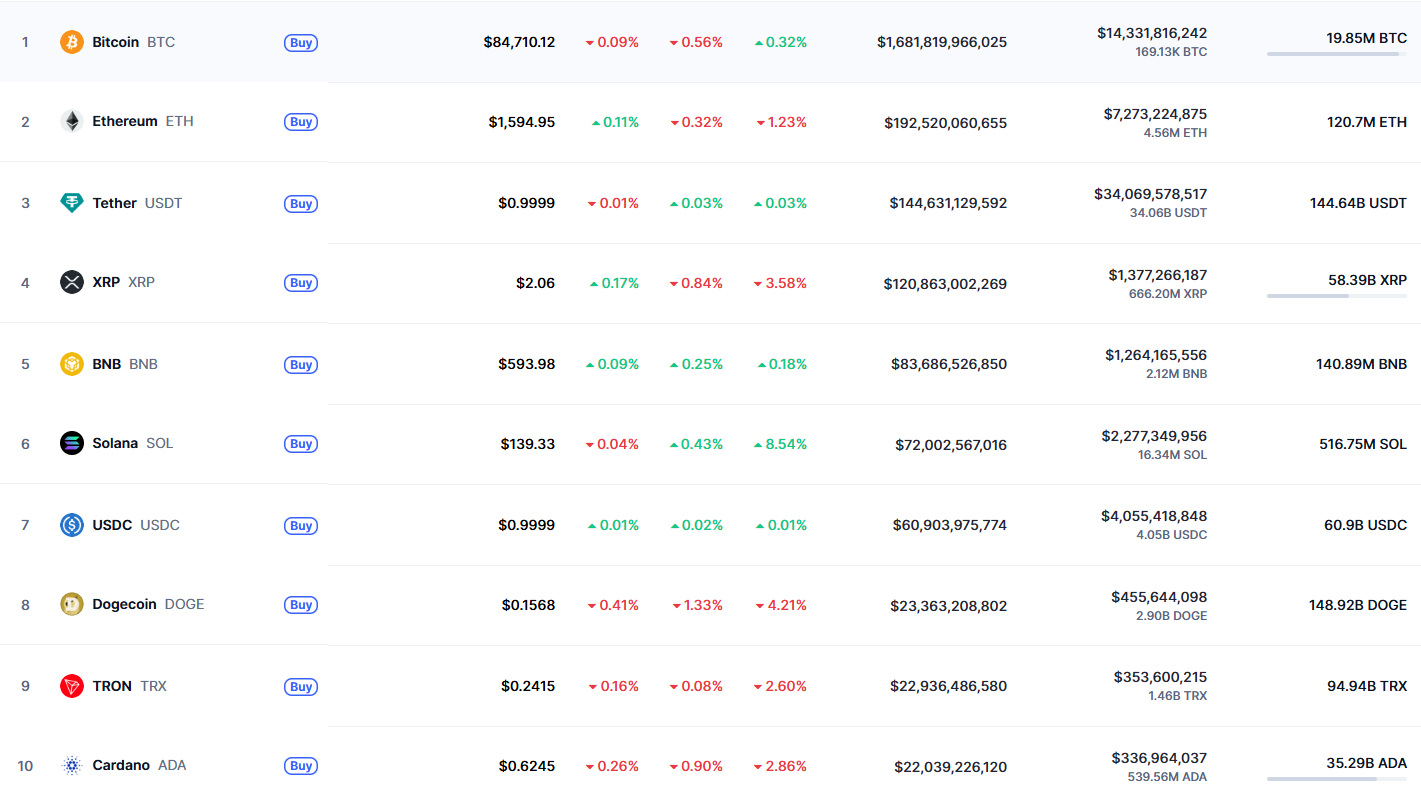

Dogecoin remains one of the top ten cryptocurrencies. Its current market capitalization stands at $23.3 billion, based on CoinMarketCap data from April 20.

Dogecoin Inflation Rate Tops $2 Million Daily

The Dogecoin network issues around 14.4 million DOGE every day. This volume results in a daily Dogecoin inflation rate exceeding $2.16 million. Despite inflation, Dogecoin holders continue to support the token, citing accessibility and familiarity.

Dogecoin inflation differs from Bitcoin or Ethereum. The token has no cap on supply. Instead, about 5 billion DOGE are added each year. This steady increase keeps the price relatively low, often under $1, and contributes to its wide retail circulation.

Dogecoin holders often emphasize the simplicity of the token’s use and branding. The token was created as a parody in 2013 but has developed a consistent user base.

Dogecoin ETF Applications Await SEC Response

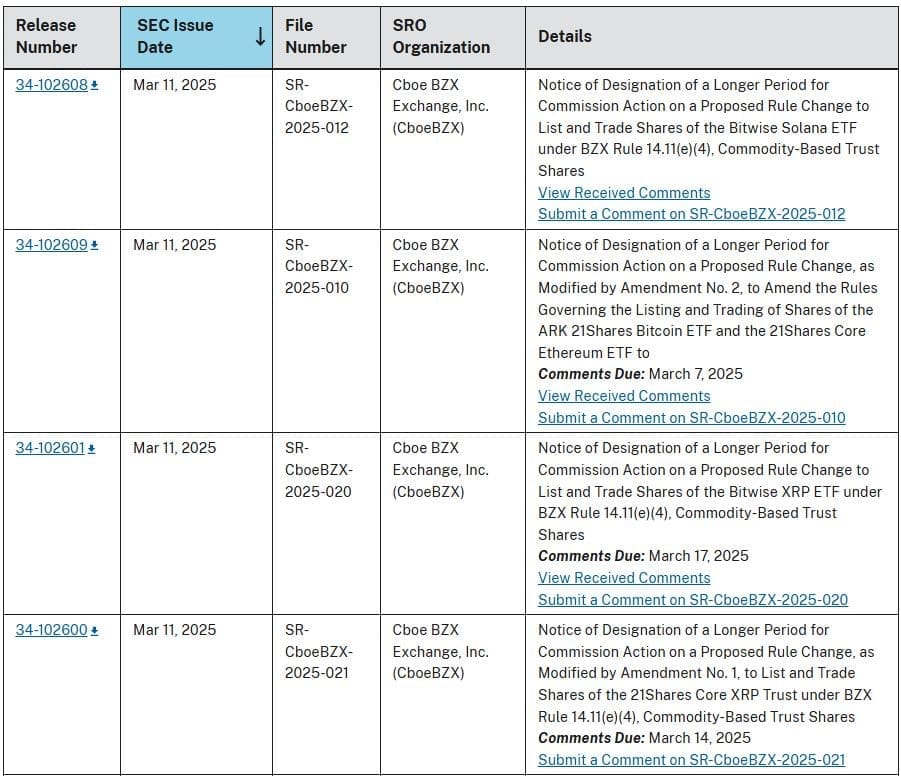

The SEC has received four Dogecoin ETF proposals. These include the Bitwise Dogecoin ETF, Grayscale Dogecoin ETF, 21Shares Dogecoin ETF, and the Osprey Fund Dogecoin ETF.

The SEC must respond to Bitwise’s Dogecoin ETF application by May 18. That deadline marks the end of the 75-day initial review under Rule 19b-4. However, the SEC can delay the process to 240 days. That extension would push a final decision to October 2024.

Grayscale’s Dogecoin ETF application has a May 21 response deadline. The SEC already delayed this filing once earlier in the year. Both filings follow the standard ETF timeline.

Meanwhile, the SEC has not released deadlines for the Dogecoin ETF filings submitted by 21Shares and Osprey. These two applications remain in the early review phase.

The Dogecoin ETF decisions arrive at a time of ongoing debate around cryptocurrency-based investment products. The SEC recently delayed rulings on several altcoin ETF proposals.

Dogecoin ETF approval timelines depend on standard SEC procedures. The agency may either accept, reject, or delay the applications during the extended period. As of now, no Dogecoin ETF has received final approval.

Dogecoin holders continue to track the filings closely. The outcome may affect DOGE’s availability to a broader set of investors through regulated financial products.

Dogecoin Retail Demand Linked to Price and Familiarity

Dogecoin holders often cite the low unit price as a reason for continued interest. Blockchain author Anndy Lian told

“Unlike Bitcoin or Ethereum, Dogecoin’s inflationary supply — adding roughly 5 billion coins annually — keeps prices accessible, typically under $1.”

He added that the meme-based identity makes it relatable to internet-native users. The branding remains a factor in its staying power despite the lack of broader use cases or smart contract features.

Dogecoin has no direct role in decentralized finance or real-world asset tokenization. However, it consistently ranks among the most talked-about digital assets online.

Dogecoin Once Surpassed Porsche’s Market Cap

In November 2024, Dogecoin briefly surpassed Porsche in market capitalization. The rise followed continued social media attention, including posts from Elon Musk. That surge placed Dogecoin above several established companies in market value.

Despite that moment, Dogecoin’s performance remains driven by retail participation and community activity. Unlike platforms such as Ethereum or Solana, Dogecoin does not support decentralized applications or smart contract protocols.

Still, Dogecoin holders remain active, particularly during events like Dogeday. The token’s community continues to engage in social media campaigns and track ETF developments as May deadlines approach.