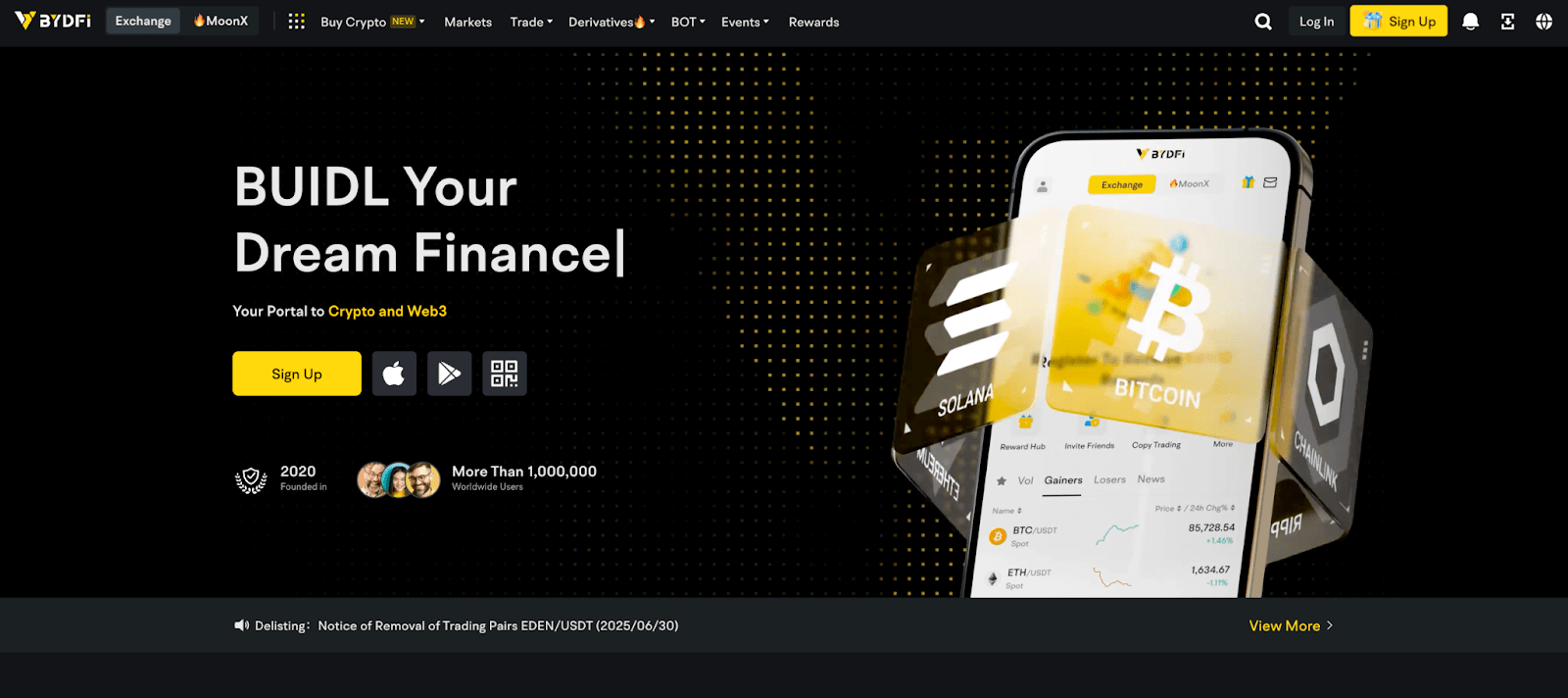

The crypto platform formerly known as BitYard started operating in 2020 before changing its name to BYDFi in 2023 to pursue its goal to help users “BUIDL Your Dream Finance.” This Singapore-headquartered exchange delivers advanced yet easy-to-use trading solutions for both new investors and expert traders. This platform acts like your crypto headquarters by providing spot trading options alongside derivatives and copy trading features.

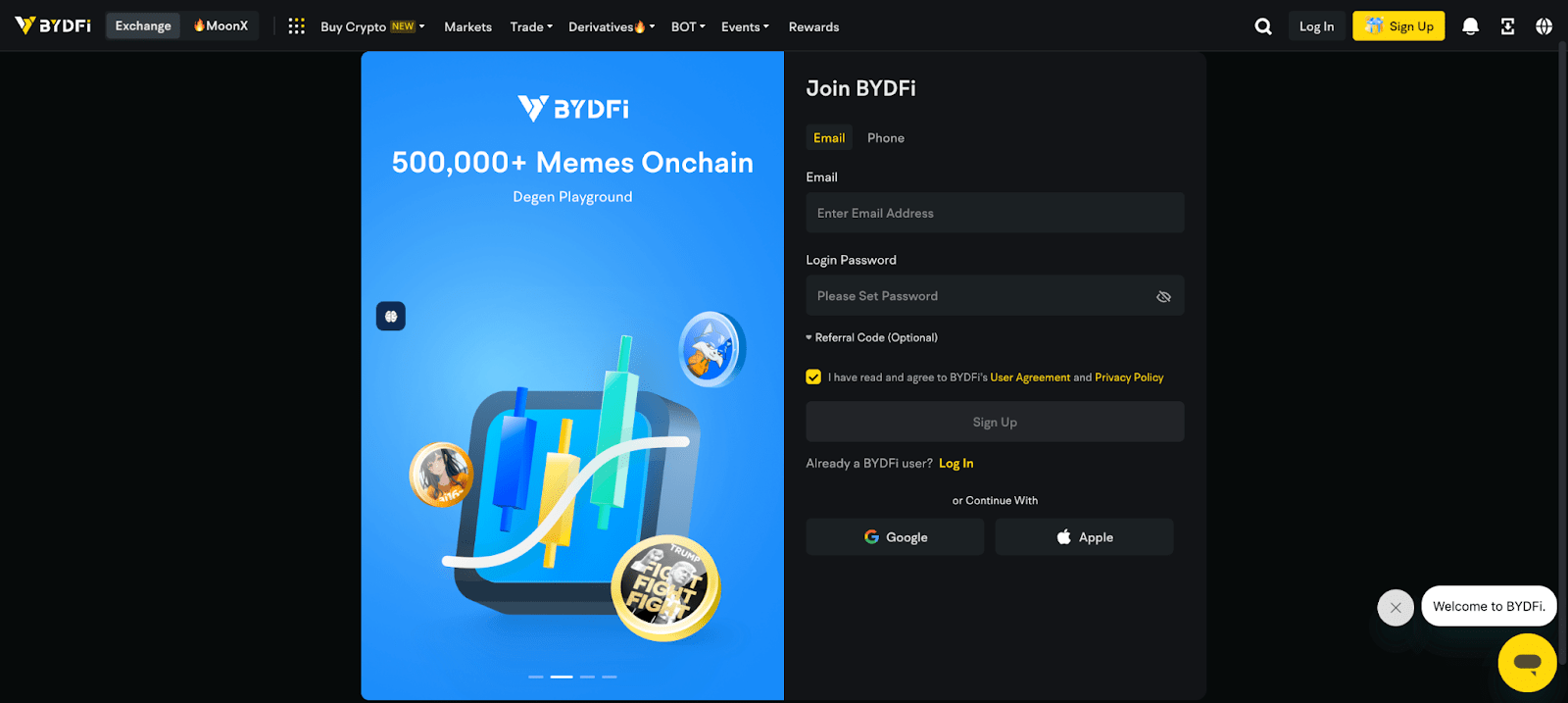

1. Creating your BYDFi account

The first step to start your experience involves creating your account. Go to BYDFi website and press the “Get Started” button. The registration process will ask you to select either email or mobile options. For this guide, we’ll go with email.

- Enter your email and password: Enter a legitimate email address and construct a secure password that hasn’t been used before.

- Verify your email: Check your inbox for a verification code. This step checks whether you are a human user and not a robot.

- Set up security measures: Activate two-factor authentication (2FA) and set up a fund password for enhanced security measures.

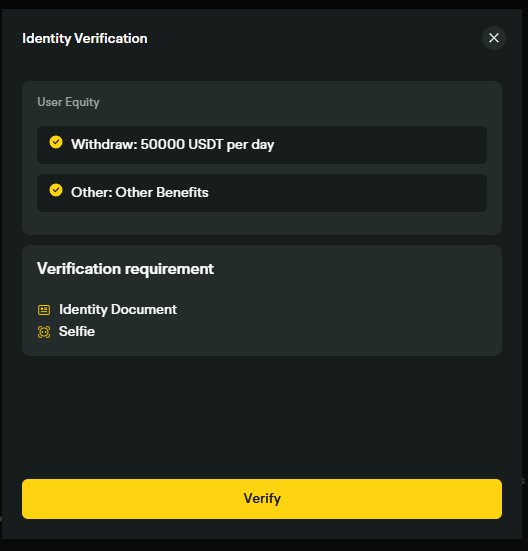

2. Verifying your identity (KYC)

The Know Your Customer (KYC) process is recommended for completion although it remains optional. Completing the KYC process grants access to higher withdrawal limits and extra features similar to obtaining a VIP pass.

- Upload your ID: Submit a legible photograph of your government-issued identification document. Make sure it’s valid and not expired.

- Complete the verification: Complete your KYC verification process by following the on-screen prompts. This step helps your account meet regulatory requirements while strengthening its security.

3. Depositing funds

With your account setup complete you should now proceed to deposit money. BYDFi provides various deposit options that support both fiat money and cryptocurrencies.

Using fiat currency:

- Navigate to deposit: Click on “Assets” and select “Deposit Now.”

- Choose your fiat currency: Choose both your preferred fiat currency such as USD or EUR and your preferred payment method. Users find credit/debit cards along with third-party services like Banxa to be popular deposit methods.

- Complete the transaction: Follow the instructions to complete the payment. Double-check every detail during the process to prevent any issues.

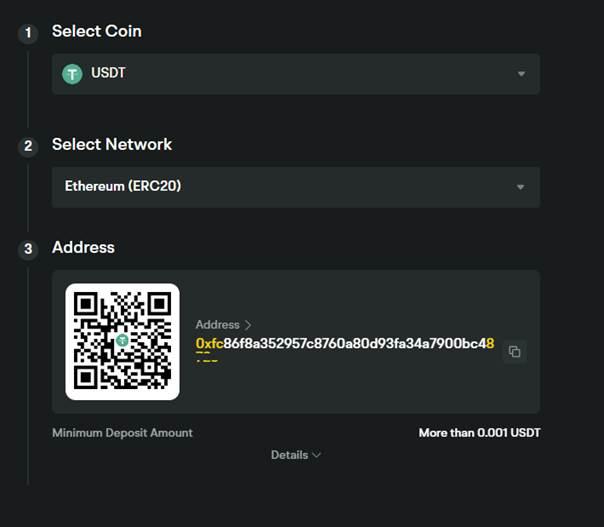

Using cryptocurrency:

- Select the cryptocurrency: Select the cryptocurrency you plan to deposit such as Bitcoin or Ethereum.

- Generate deposit address: BYDFi will provide a wallet address. Inspect the payment address and network thoroughly to avoid losing funds.

- Transfer funds: Move the cryptocurrency from your wallet to the given address. You need to wait for confirmation since blockchain transactions require time to complete.

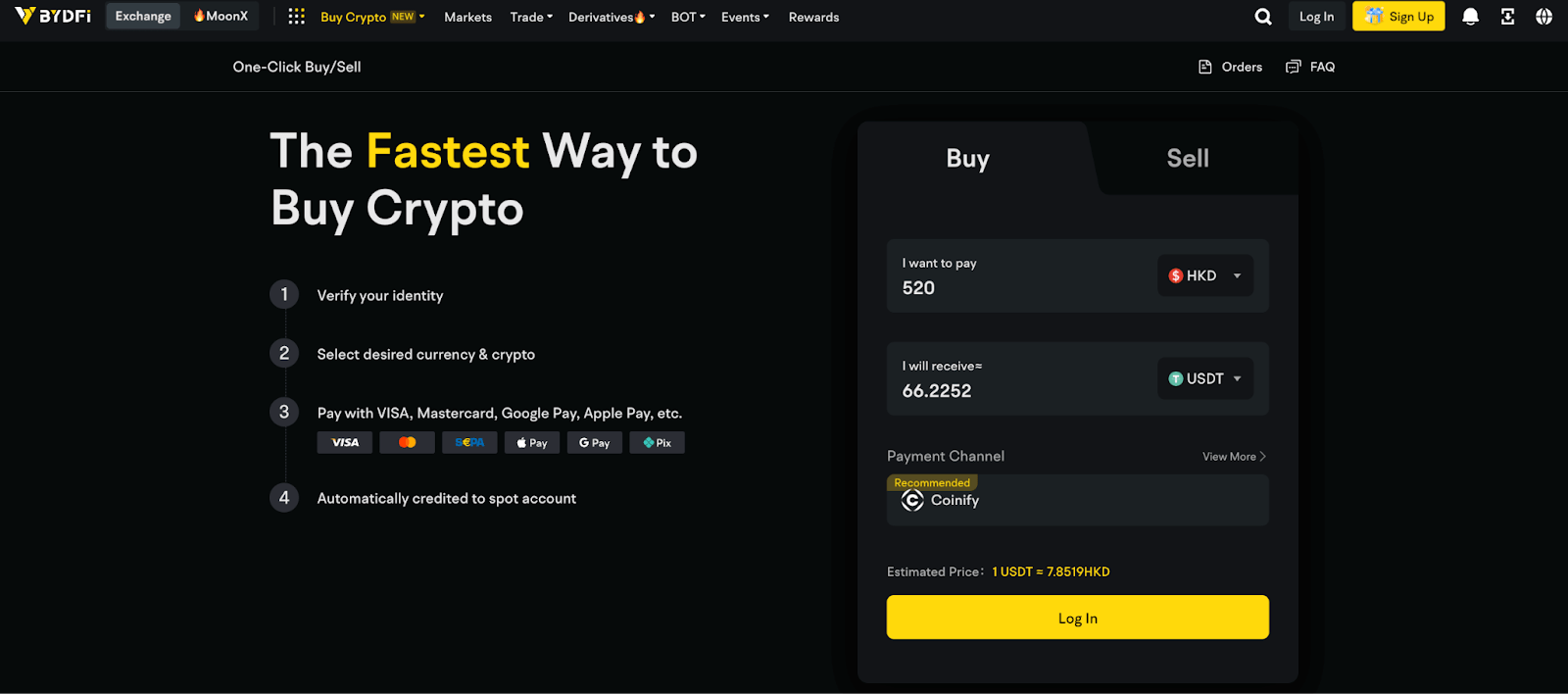

4. Buying cryptocurrency

You can purchase cryptocurrencies directly from your account funds via the Spot Market.

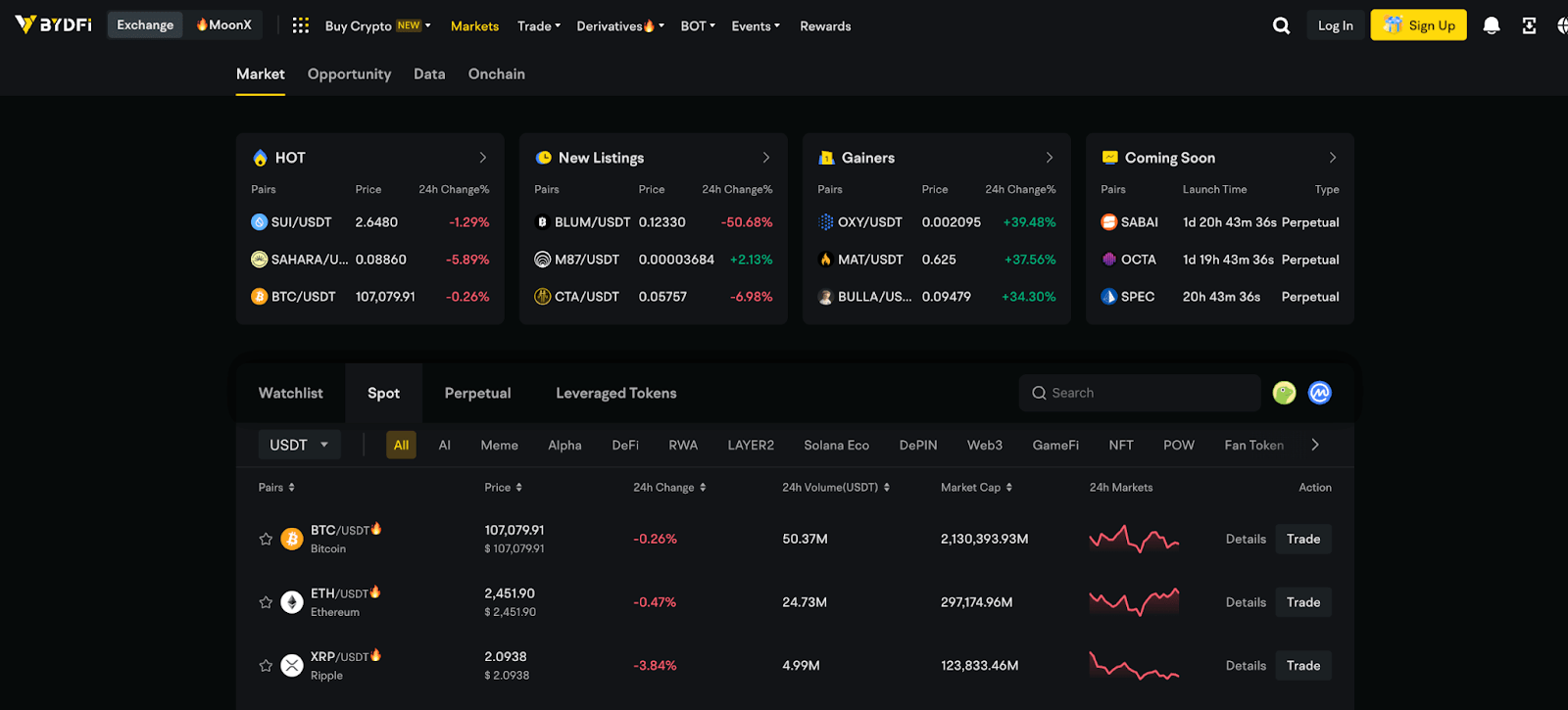

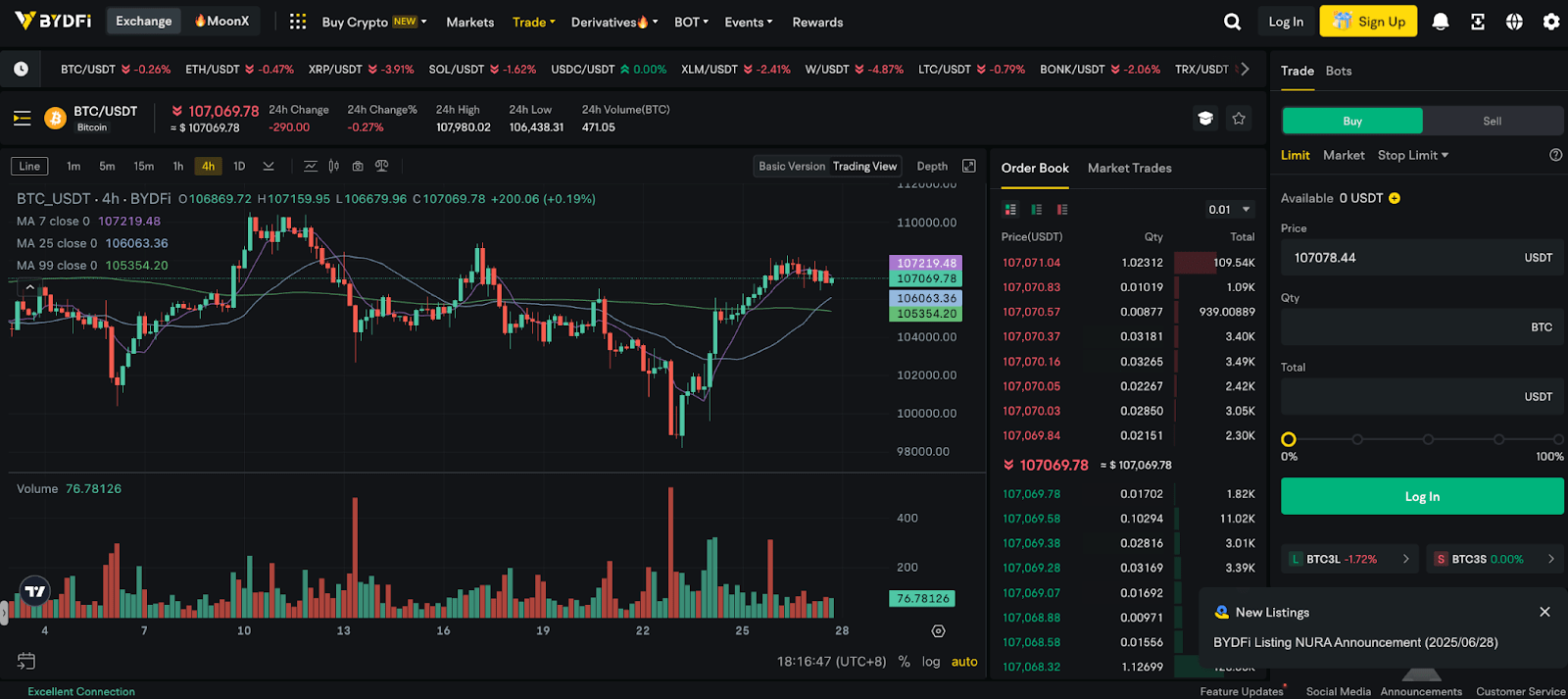

- Navigate to the Spot Market: Click on “Trade” and select “Spot Trading.”

- Select the trading pair: Buy the desired cryptocurrency through the correct trading pair selection (such as BTC/USDT).

- Place an order:

- Market order: Buy cryptocurrency at the current market price.

- Limit order: Determine the exact amount you are willing to pay for purchasing the cryptocurrency.

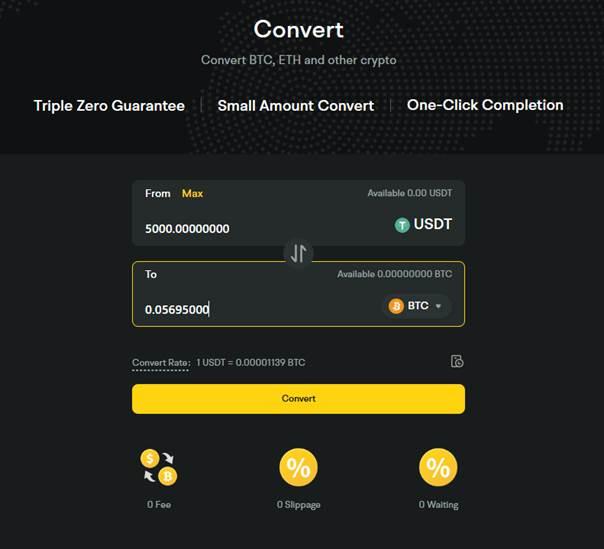

Convert and OTC portal

Exchange cryptocurrencies quickly and easily through the Convert and OTC Portal.

- Access the portal: Click on “Trade” and select “Convert.”

- Select the cryptocurrencies: Select the cryptocurrencies you wish to convert by choosing both the source and target coins.

- Enter the amount: Specify the amount you want to convert.

- Confirm the transaction: Review the details and confirm the conversion.

5. Managing your cryptocurrency

Your cryptocurrency will show up in your BYDFi wallet after your order gets executed. Here’s what you can do next:

- Keep it on BYDFi: You can store your cryptocurrency on the exchange to trade easily. Storing crypto on BYDFi is similar to keeping cash in your wallet because it is secure yet remains less safe than other options.

- Transfer to a wallet: Enhance your crypto security by moving your assets into a hardware wallet. It is equivalent to transferring your valuables into a safe deposit box.

The bottom line

The BYDFi platform enables newcomers to purchase cryptocurrency through an uncomplicated procedure that they can easily understand. The combination of BYDFi’s approachable interface and secure system along with its versatile payment methods makes it a perfect platform for newcomers to cryptocurrency. BYDFi delivers essential trading tools and resources whether you are new to crypto or looking to broaden your investment options. Join BYDFi today to begin your cryptocurrency experience.