Bitwise Chief Investment Officer Matt Hougan expects Ethereum exchange-traded funds (ETFs) to attract up to $10 billion in inflows by the end of 2025. Speaking on July 2, Hougan said the recent surge in demand could accelerate through the second half of the year.

According to SoSoValue data, Ethereum ETFs brought in $1.17 billion in June alone. Total inflows reached $1.5 billion in the first six months of 2025. While the sector saw $403 million pulled in March, five out of six months recorded net gains.

Traditional investors show interest in Ethereum ETFs

Hougan pointed to Ethereum’s role in hosting tokenized assets as a key factor. He said stablecoins and tokenized stocks now offer a clear narrative for traditional investors. In his words:

“Flows into Ethereum ETFs are going to accelerate significantly in H2. The combination of stablecoins & stocks moving over Ethereum is an easy-to-grasp narrative for traditional investors.”

Major institutions like BlackRock and Robinhood are already using Ethereum for asset tokenization. This trend has helped position Ethereum as a leading infrastructure layer in the crypto sector.

Staking ETFs and network upgrades support demand

Meanwhile, upcoming Ethereum staking ETFs could drive further interest. The U.S. Securities and Exchange Commission (SEC) recently clarified that crypto staking does not qualify as a securities offering. This shift could open the door for new Ethereum-based financial products.

Ethereum is also rolling out major technical upgrades. The Pectra upgrade is live, while the Glamsterdam release is underway. Both aim to improve scalability and network performance.

Hougan’s forecast aligns with these developments. He sees Ethereum ETFs benefiting from strong demand, infrastructure upgrades, and regulatory clarity heading into late 2025.

Ethereum’s Pectra Upgrade to Boost Scalability, Cut Fees, and Add Smart Accounts

Ethereum’s upcoming upgrade, called Pectra, is scheduled for release in March. It combines two planned updates—Prague and Electra—into one coordinated release. Together, these changes will improve both the execution layer and the consensus layer of the Ethereum network. The goal is to improve speed, lower costs, and add flexibility for users and developers across the ecosystem.

Since its launch in 2015, Ethereum has introduced around 20 major upgrades. Each one implements Ethereum Improvement Proposals, or EIPs. These proposals fix weak points in the network and bring new features. Ethereum must keep evolving to stay ahead of other Layer 1 blockchains that promise faster speeds or lower fees. In the crypto space, such competition is common. Developers often refer to these rivals as “Ethereum killers,” a term that reflects how often Ethereum’s leadership is challenged.

In 2022, Ethereum reached a key milestone with The Merge. This upgrade shifted the network from Proof of Work to Proof of Stake. Since then, holders of ETH can stake their tokens and earn rewards. A year later, in 2024, Ethereum rolled out the Dencun upgrade. That update reduced gas fees on Layer 2 networks and helped boost usage on platforms like Coinbase’s Base blockchain. Now, the Pectra upgrade marks another major leap, one that the Ethereum community has closely anticipated.

Pectra is expected to improve scalability by raising the number of transactions Ethereum can process per second. This will help support the growing number of decentralized applications and users on the network. The upgrade will also lower gas fees by making data storage and processing more efficient. That change should make Ethereum more affordable and accessible to both new users and experienced developers. On the security front, Pectra introduces updated cryptographic protections. These enhancements will strengthen how smart contracts and user data are handled on the blockchain.

A key part of the upgrade is the introduction of smart accounts. Before this change, user accounts could only send and receive tokens. With Pectra, these same accounts can now behave like smart contracts. Users will be able to group multiple transactions and even pay gas fees using different cryptocurrencies. This change will simplify how people interact with Ethereum, making the network easier to use and more flexible.

Several Ethereum Improvement Proposals form the technical foundation of Pectra. One of them raises the validator balance limit from 32 ETH to 2,048 ETH. This will reduce the number of validators and improve the network’s efficiency. Another proposal introduces account abstraction, allowing user accounts to temporarily act like smart contracts. That means more control over transactions and better gas management. Pectra also brings a change to how much data Ethereum can process per block by adjusting blob capacity. That’s key for scaling Layer 2 solutions. The upgrade will also move validator deposit processing directly onto the consensus layer, speeding up onboarding and improving system security. Smart contract-controlled withdrawals will give users more control over staking. And expanded blob processing will allow Ethereum to manage more data without slowing down or raising fees.

With Pectra, Ethereum continues to build on its long-term roadmap. Each upgrade brings the network closer to solving the long-standing problems of speed, cost, and scalability. As the platform evolves, developers and institutions alike will watch closely to see how Ethereum maintains its lead in a competitive environment. The Pectra upgrade is not just another technical step—it’s part of Ethereum’s ongoing strategy to stay secure, scalable, and easy to use for everyone.

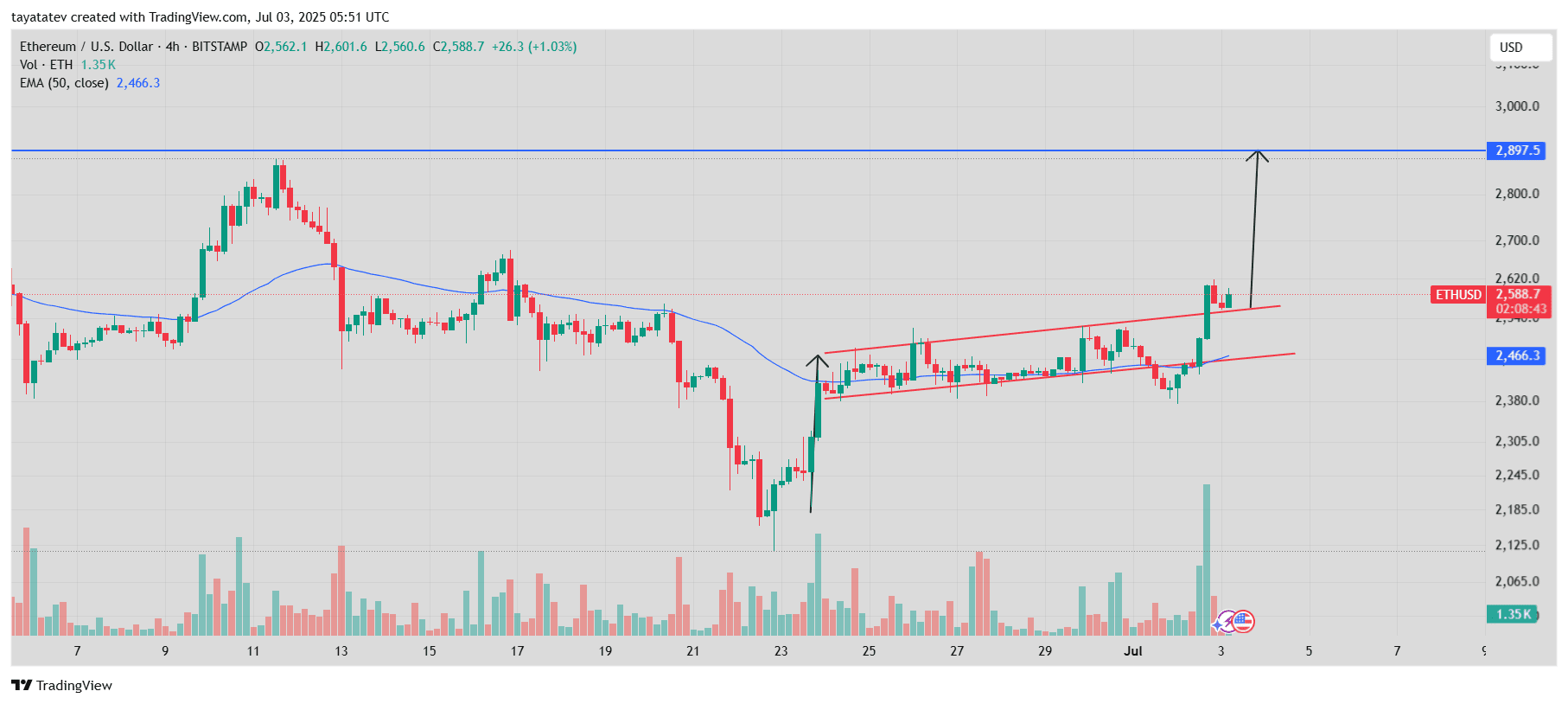

Ethereum Breaks Out of Ascending Channel With 12% Upside Target Toward $2,897

Ethereum ETH/ USDT formed an ascending channel pattern between June 23 and July 3, 2025, visible on the 4-hour chart. An ascending channel is a bullish chart pattern marked by higher highs and higher lows, enclosed within two parallel upward-sloping trendlines.

On July 3, Ethereum broke out of the pattern near the $2,560 level with strong volume. The price surged nearly 2% above the channel resistance, confirming the breakout. At the time of the chart, ETH was trading at $2,588.7.

Based on the channel height and breakout confirmation, the projected move suggests a 12% gain from the breakout point, targeting the next major resistance at $2,897.5. That level aligns with the previous local top seen in early June.

The 50-period Exponential Moving Average (EMA), currently near $2,466, has started curving upward, confirming bullish short-term momentum. Ethereum also bounced off this EMA earlier, showing strong demand near that zone.

Volume also supports the move. The green volume bars on July 3 show a clear spike, suggesting buyers stepped in aggressively at the breakout.

If Ethereum holds above the breakout point near $2,560, the bullish continuation toward $2,897 remains likely. However, any dip below $2,520 could signal a false breakout or short-term consolidation.

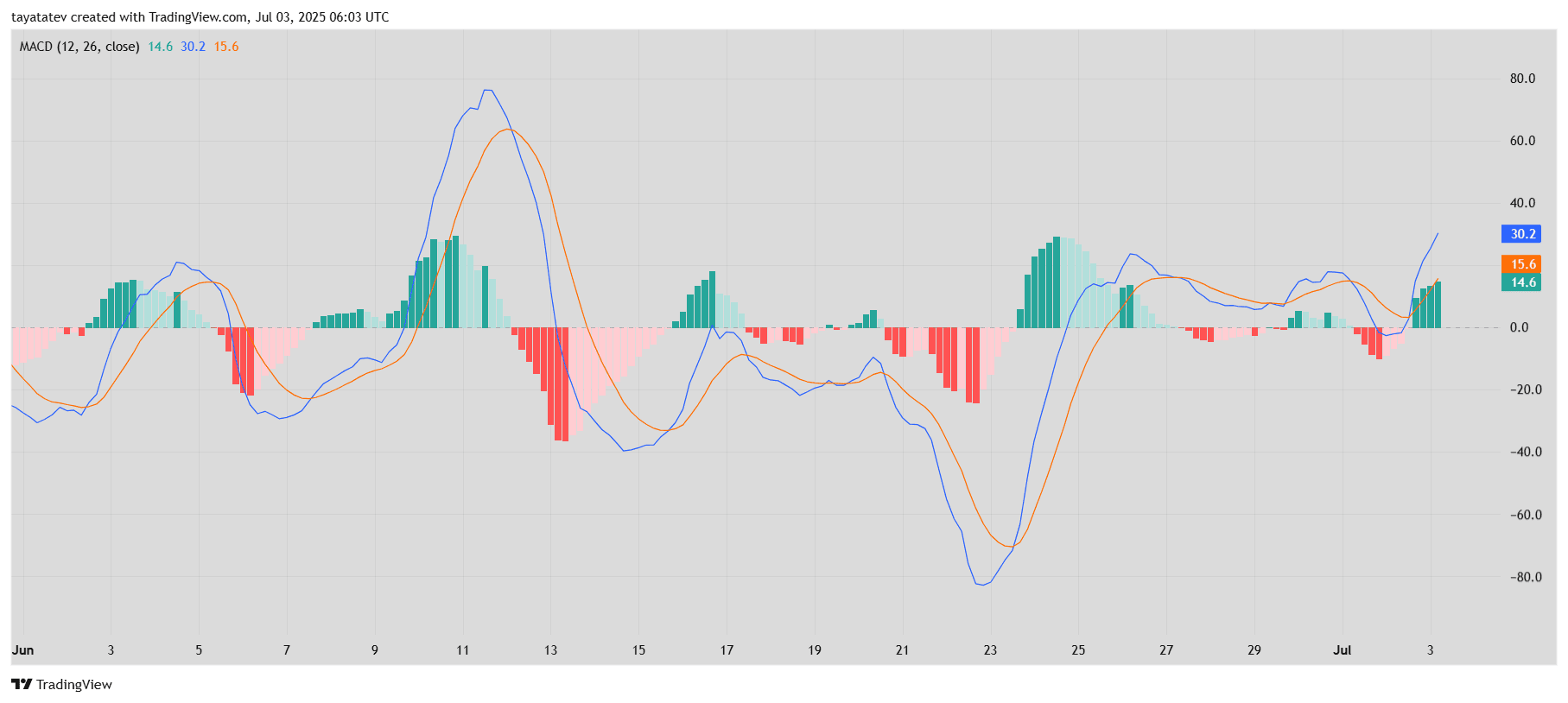

Ethereum MACD Shows Bullish Crossover as Momentum Builds

On July 3, 2025, Ethereum’s Moving Average Convergence Divergence (MACD) indicator confirmed a bullish signal on the 4-hour chart. The blue MACD line crossed above the orange signal line, marking a bullish crossover. This move happened near the zero line and was followed by rising green histogram bars, indicating increasing bullish momentum.

The MACD line currently reads 30.2, while the signal line sits at 15.6. The histogram has flipped above zero, reinforcing the upward shift. At the same time, the previous bear cycle showed a loss of strength with fading red bars—setting up for this reversal.

The MACD (Moving Average Convergence Divergence) indicator tracks the relationship between two exponential moving averages (typically the 12-period and 26-period). A bullish crossover happens when the faster EMA crosses above the slower one, suggesting momentum is turning in favor of buyers.

With this signal in place, Ethereum could extend its rally, especially as it aligns with the breakout from the ascending channel seen on the price chart. If the MACD continues to rise and the histogram expands further, it would support the 12% price target toward $2,897. However, any drop in histogram strength or a bearish crossover would weaken this outlook.

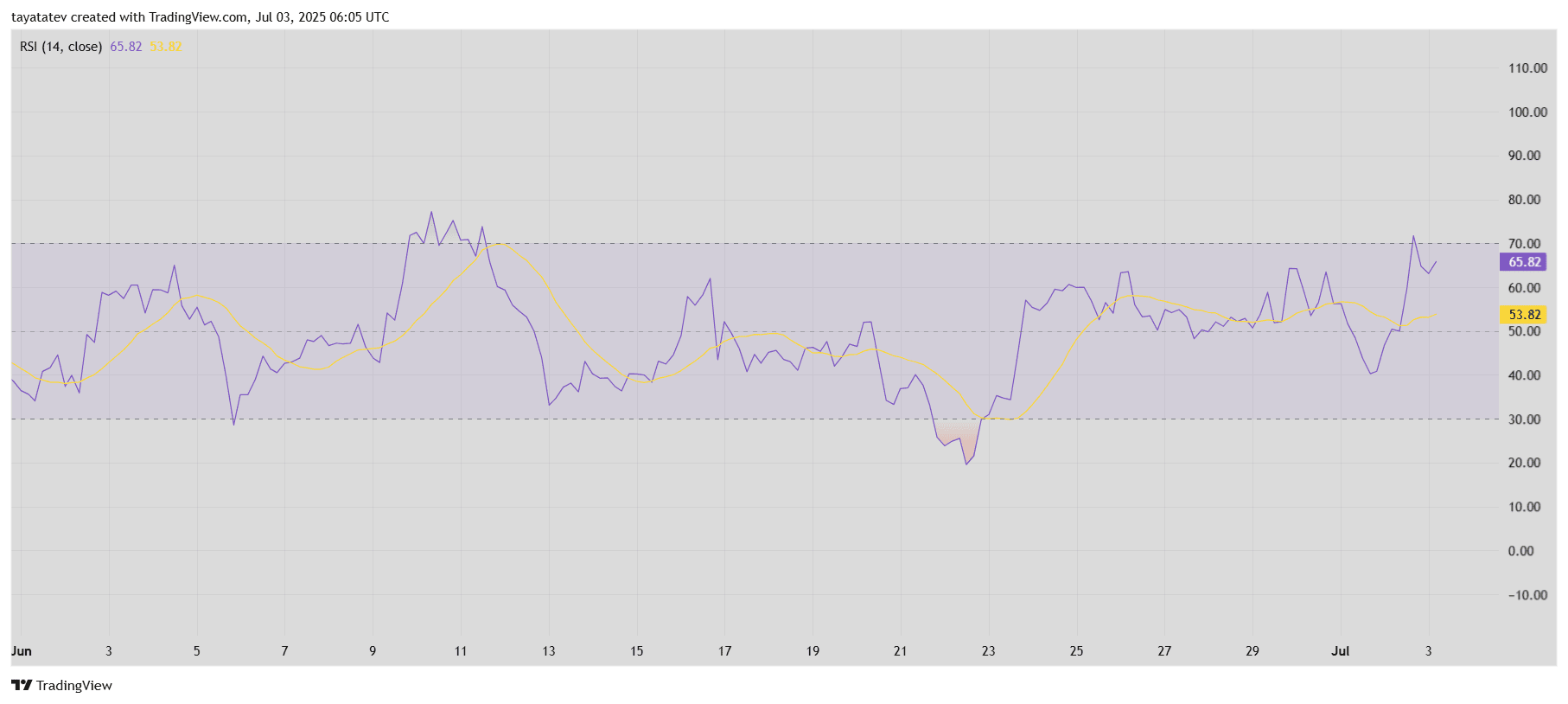

Ethereum RSI Approaches Overbought Zone, Signals Rising Momentum

As of July 3, 2025, Ethereum’s 4-hour Relative Strength Index (RSI) stands at 65.82, moving steadily toward the overbought threshold of 70. The RSI crossed above its 14-period moving average, currently at 53.82, confirming strong bullish momentum.

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. Readings above 70 often suggest overbought conditions, while levels below 30 suggest oversold conditions.

Ethereum’s current RSI spike comes after a sharp recovery in price and aligns with the recent breakout from the ascending channel. The RSI’s sharp rise indicates increased buying pressure, which supports the ongoing bullish trend.

If the RSI enters the overbought zone and stays there, it could signal sustained bullish momentum. However, a sharp reversal below the moving average might suggest fading strength.

This momentum indicator now confirms signals from both the MACD and price breakout chart, strengthening the short-term bullish case for Ethereum.