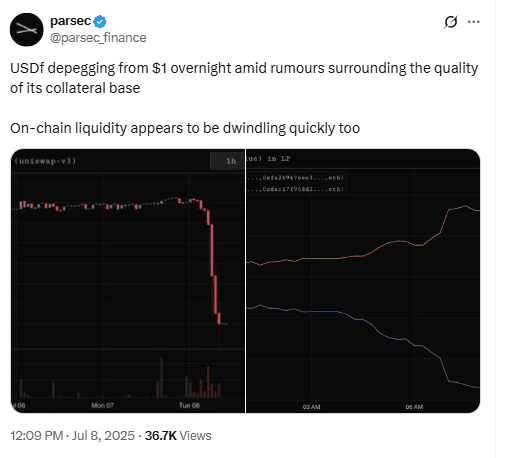

USDF stablecoin, issued by Falcon Futures and backed by DWF Labs, dropped to 94.3 cents on July 8, 2025. The depeg lasted almost one hour. It affected the stablecoin’s parity with the U.S. dollar and sparked concerns in the crypto sector.

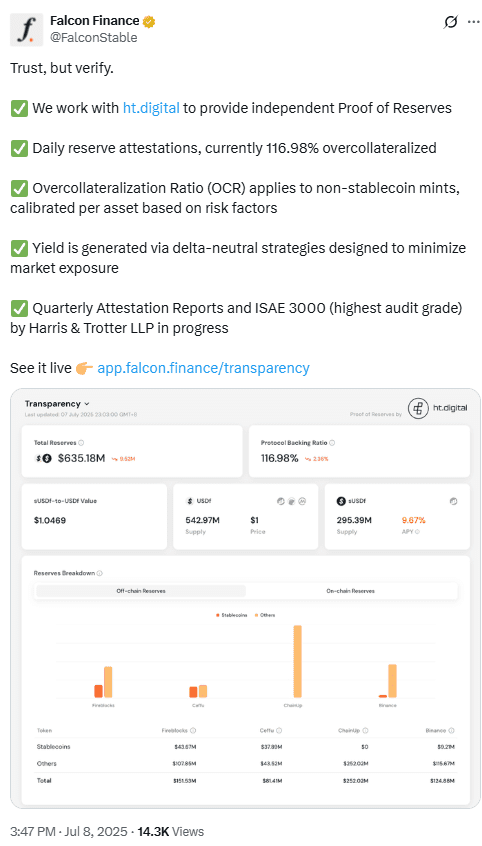

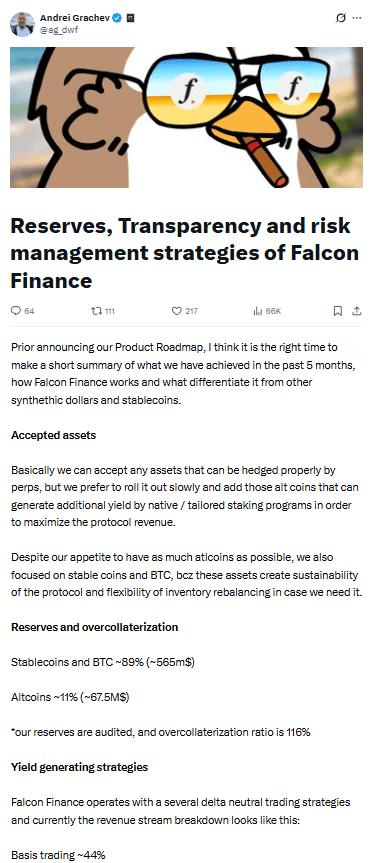

Falcon Futures said USDF is 116% overcollateralized. However, the data showed that most of the USDF stablecoin reserves are not on the blockchain. The company reported $609 million in off-chain reserves and only $25 million on-chain. The value of assets behind the stablecoin remains unclear.

The USDF stablecoin reached over $570 million market cap shortly after launch. At the time of the peg break, it had a market capitalization of over $540 million. The project is linked to DWF Labs, which has recently worked on Trump crypto initiatives.

Over $609M in USDF Stablecoin Reserves Remain Off-Chain

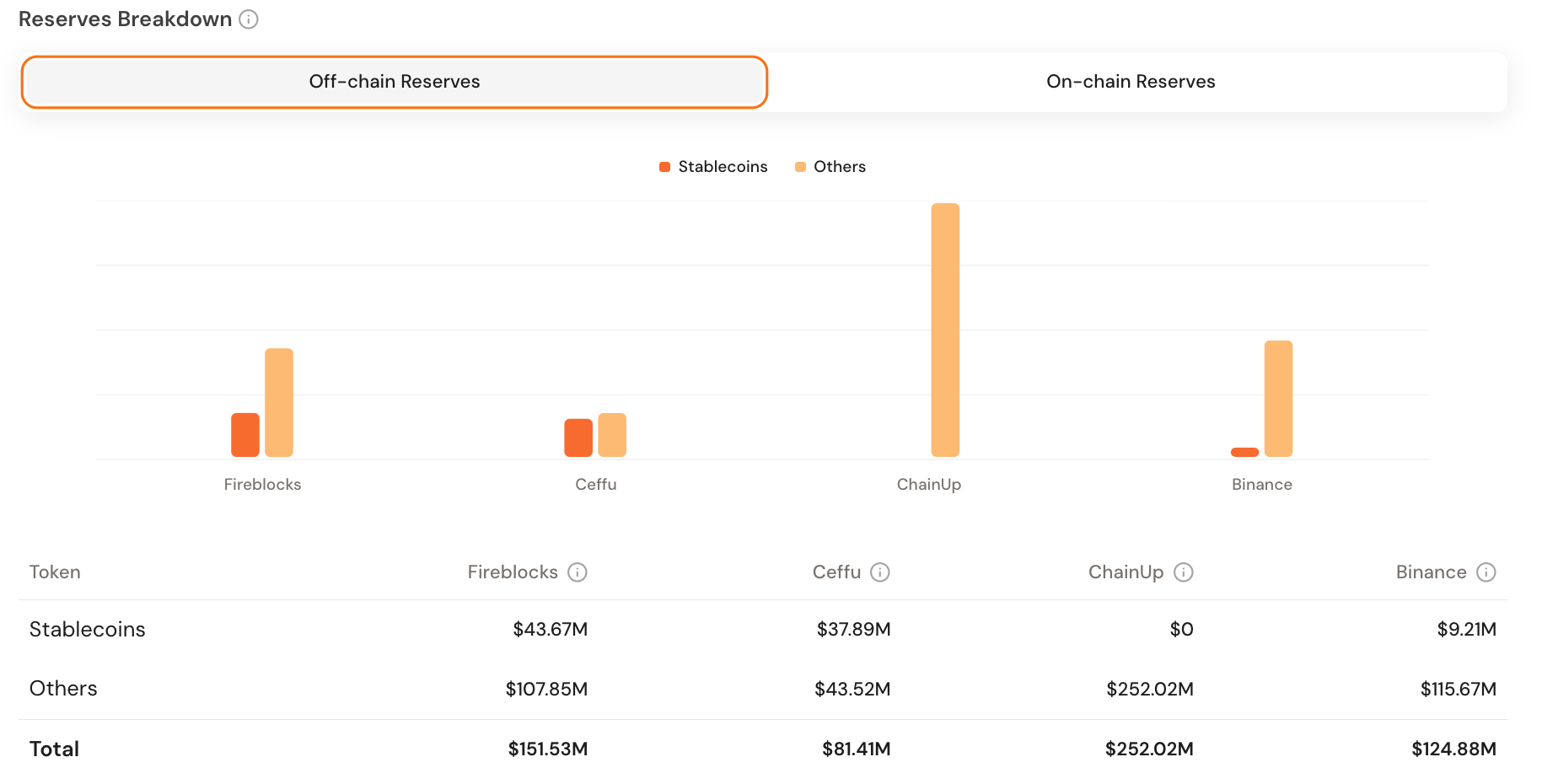

Public records from Falcon Finance show that most of the USDF stablecoin reserves are held off-chain. Only a small portion—$25 million—remains on-chain. The rest, about $609 million, is not verifiable on public blockchain data.

No details were given about the assets used as collateral. There is no official list of stablecoins or cryptocurrencies backing the reserve. Falcon Futures did not publish any names or breakdowns of the reserve assets. It also did not provide information about liquidity or price impact during liquidation.

DWF Labs said it will release full data about the USDF stablecoin reserves next week. Until then, the reserve structure remains unknown. The lack of clear details contributed to the reaction after the USDF stablecoin dropped below the dollar peg.

DeFi Risk Group Flags Unilateral Reserve Management

LlamaRisk, a DeFi risk assessor, shared concerns after the incident. It said the USDF stablecoin lacks transparency in its reserve operations. In a post, LlamaRisk wrote that the Falcon Futures team has full control over how the reserves are managed.

“The Falcon team has unilateral authority over the operational management of the reserve assets. Insolvency may occur due to operational mismanagement or failure of underlying strategies which include exposure to CEX exchanges and DeFi strategies,”

the statement read.

LlamaRisk noted that off-exchange custodians handle most of the USDF stablecoin reserves. However, no audit report confirms their risk management practices. The company has not explained how it protects funds from exchange failures or price drops.

DWF Labs Role in Trump Crypto Projects Draws More Attention

DWF Labs is also involved in other Trump crypto initiatives, including support for World Liberty Financial’s USD1 stablecoin. This token aims to connect traditional finance systems with dollar-backed crypto products.

Following the USDF stablecoin incident, users online linked the event to DWF’s broader activities. The firm has faced earlier accusations, including wash trading and misconduct by affiliated individuals. One previous partner was accused of drugging a job applicant.

DWF’s involvement in both USDF stablecoin and Trump crypto initiatives raises questions about operational practices. The firm has not responded to past accusations in public court filings. The USDF stablecoin depeg remains the latest event to draw attention to its role.

Audit Reports Not Published, Breakdown Still Pending

Falcon Futures has not published any detailed audit of the USDF stablecoin reserves. The company claims the stablecoin is 116% backed, but no public document confirms this figure. On-chain data shows only $25 million, while over $609 million is off-chain.

Reserves lack clear documentation on asset types, diversification, or conversion timelines. As a result, the current status of the USDF stablecoin remains unclear.

DWF Labs announced it will release a full breakdown soon. However, it has not confirmed a date or format for the disclosure.