Shiba Inu may be flashing signs of a technical rebound, but on-chain data reveals that the smartest meme coin traders aren’t just watching SHIB anymore. Now, they’re already moving into something fresher, faster, and more promising: Little Pepe ($LILPEPE). This new meme coin has been turning heads with its record-breaking presale and, even more, its groundbreaking roadmap. Let’s break down why SHIB’s potential comeback might not be enough to stop the meme money migration.

SHIB Finds Support, but It’s Still Down 19% from Monthly Highs

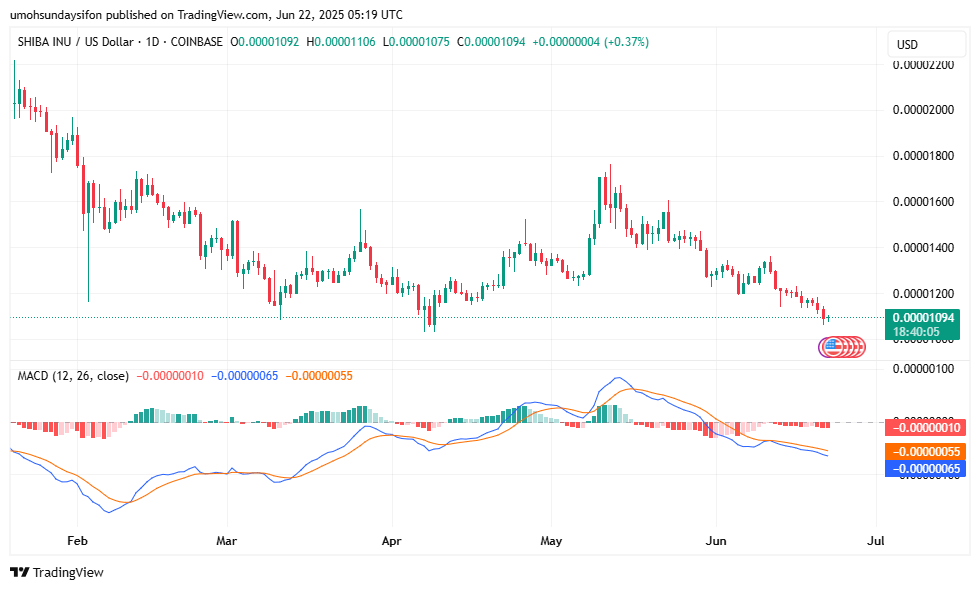

Since reaching its highest point on June 11, Shiba Inu has lost 19% of its value. The coin has fallen from $0.000014 to a low of $0.0000108. The drop is a sign of more general market volatility. However, it served as a warning for regular investors who were anticipating further gains.

Despite the pullback, the order books tell a more bullish story. IntoTheBlock data shows SHIB buy orders exceeding sell orders by over 3.1 trillion tokens, creating a net buy wall that could act as a springboard for a short-term rally. This sets up the possibility of a breakout, but there’s one problem. Even as SHIB tries to stabilize, attention from major meme coin investors is already drifting elsewhere.

Smart Traders Sniff Opportunity Before the Crowd—and They’re Buying $LILPEPE

While SHIB eyes a 50% bounce if technical resistance breaks at $0.000012, a newer meme token is gaining traction and hasn’t even launched yet. Little Pepe, a meme coin building its own Layer 2 blockchain just for meme tokens, is currently in Stage 3 of its presale, having already raised over $1.5 million. It offers something no other meme coin does:

- A sniper bot-proof launch model

- Zero tax on buys/sells

- A meme Launchpad on its own chain

- And confirmed listings on two top-tier cryptocurrency exchanges (CEXs) post-launch.

The project also boasts anonymous experts who’ve backed some of the most successful meme coin runs in the last two cycles. For high-stakes meme traders, $LILPEPE isn’t just a coin—it’s a pre-viral ecosystem in the making.

SHIB’s Falling Wedge Shows Hope—But It Might Be Too Late

Back to SHIB: technically, the setup isn’t bad. An emerging falling wedge shape in the chart indicates a reversal. If it breaks $0.000012, bulls might push SHIB to $0.000017, a 50% gain. However, as MACD divergence grows and buy orders accumulate, any comeback might be dramatic but short-lived, especially since traders see superior risk-reward in younger tokens.

Additionally, if SHIB fails to hold $0.000011, a decline toward $0.000010 is possible, leaving only major historical demand zones remaining. That’s a narrow path for a meaningful upside, and it’s not enticing enough for whales or fast-money meme chasers anymore.

A $500 Bet on LILPEPE Could Turn Into a Fortune Before Most Even Notice

While older meme coins crawl for modest gains, Little Pepe is still in early presale, trading at just $0.0012—and that’s where the real upside lives. If $LILPEPE hits just $0.12, a level within reach for high-utility meme tokens with viral momentum, that’s a 100x return. That means a $500 investment today could become $50,000, not over the years, but potentially in the same timeframe that SHIB exploded in 2021. And this isn’t hopium. Little Pepe combines the virality of an early SHIB with the utility of the Solana blockchain. In short, it’s the kind of setup seasoned meme coin traders dream about, but it’s still under $0.002. That window won’t stay open long.

How to Buy LILPEPE in Under 2 Minutes

Crypto investors understand that timing is everything when it comes to being a big winner and a sore loser. With stage 3 of the presale almost complete, getting in early is no longer debatable. Here is how:

- Download MetaMask or Trust Wallet

(Make sure it’s on Ethereum mainnet)

- Load ETH or USDT (ERC-20)

Transfer from your exchange to your wallet.

- Go to littlepepe.com Tap “Buy Now,” connect your wallet, and purchase.

- Claim after the presale ends

Just revisit the site and claim your tokens.

That’s it. No tax, no bots, just early access to a potential 100x gem before listings go live.

The giveaway is doing precisely what SHIB used to do in its early days—turning holders into marketers, expanding reach, and creating massive viral pressure just before CEX listings hit.

Final Take: SHIB May Bounce, But $LILPEPE Is Where the Smart Money’s Already Going

Shiba Inu has its crowd, and a rebound to $0.000017 is still technically in play—but the next real wave is forming elsewhere. Little Pepe is backed by utility, designed for virality, and primed for an aggressive exchange debut. Smart traders are making their moves now, not when it’s already 10x higher.

Don’t be the person chasing green candles after the fact.

👉 Join the $777K Giveaway

👉 Buy $LILPEPE before Stage 3 ends at littlepepe.com 👉 Get in before the meme coin kingmakers crown a new ruler

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

Disclaimer: The views and opinions presented in this article do not necessarily reflect the views of CoinCheckup. The content of this article should not be considered as investment advice. Always do your own research before deciding to buy, sell or transfer any crypto assets. Past returns do not always guarantee future profits.