Key Insights:

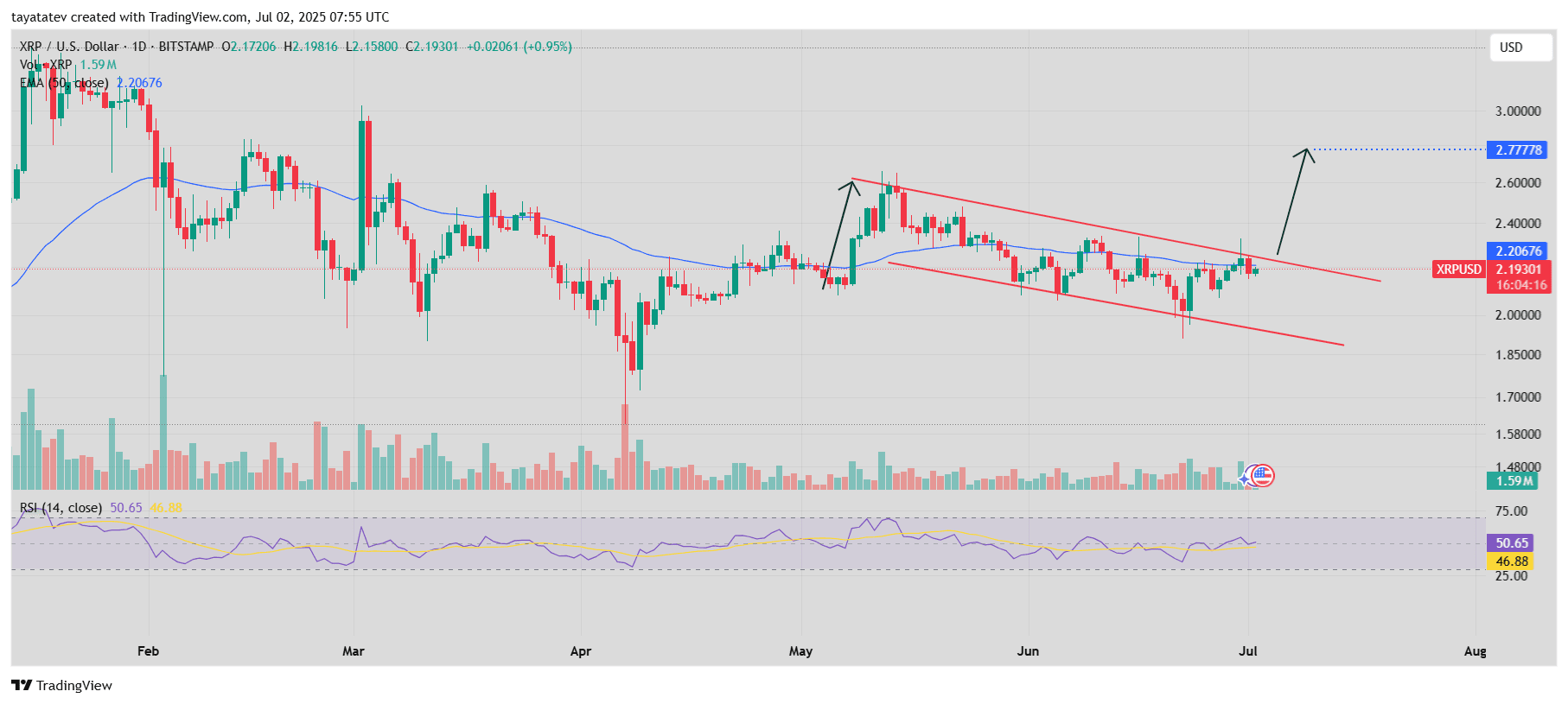

- XRP is currently range-bound between $2.00 and $2.35, with $2.35 acting as strong technical resistance.

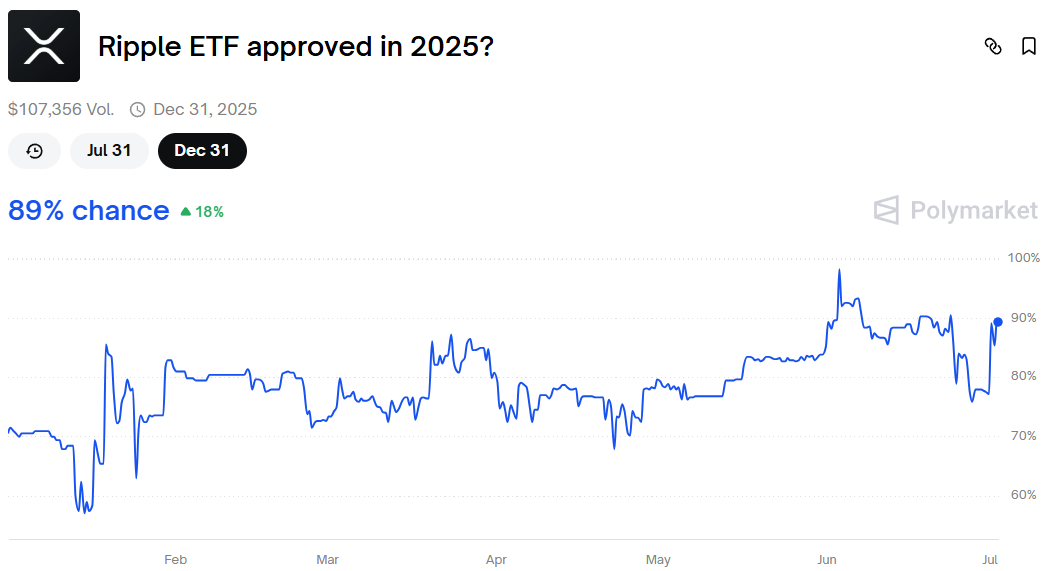

- Despite an 88-95% probability of an XRP ETF approval by Bloomberg analysts and Polymarket, a rally towards $3 could be tough to pull off.

- A clear break above $2.35 is important for XRP to push towards $2.65, while a drop below $2.00 could lead to a decline towards $1.61.

XRP has once again found itself in the spotlight, with its price fluctuating between $2.00 and $2.35. Many traders are now watching its price closely for any signs of a breakout.

And at the center of this speculation is the increasing possibility of an XRP exchange-traded fund (ETF) being approved by the U.S. Securities and Exchange Commission (SEC). Despite the buzz, XRP is still battling technical resistance, and here is why any predictions for a $3 rally could be facing some serious headwinds.

XRP Faces Resistance at $2.35

The token has been range-bound between $2.00 and $2.35 for months now, with the upper end of the range being especially difficult to break.

According to the charts, buyers briefly pushed XRP above the 50-day simple moving average around $2.24) earlier this week. However, the bears quickly stepped in and in the short term, all eyes are on the 20-day EMA at $2.17.

All of this said, if XRP manages to bounce off this price level, it could make another attempt to break above $2.35.

If the bulls are successful here, prices could have a real chance at pushing towards $2.65 and possibly higher. However, if bears push the price below the 20-day EMA, the next support zones are at $2.06 and $2.00.

A break below the $2 price level would be a slippery slope for XRP, and could even cause a price dump towards $1.61.

The XRP ETF Speculation

Much of this optimism is coming from the possibility of an XRP ETF approval in 2025.

According to Bloomberg ETF experts Eric Balchunas and James Seyffart, there is currently a 95% chance that ETFs for XRP, Solana and Litecoin will be approved next year.

Here are mine and @EricBalchunas‘ most recent odds on spot crypto ETF approvals by the end of 2025. We expect a wave of new ETFs in this second half of 2025. pic.twitter.com/H3pxJhqMy3

— James Seyffart (@JSeyff) June 30, 2025

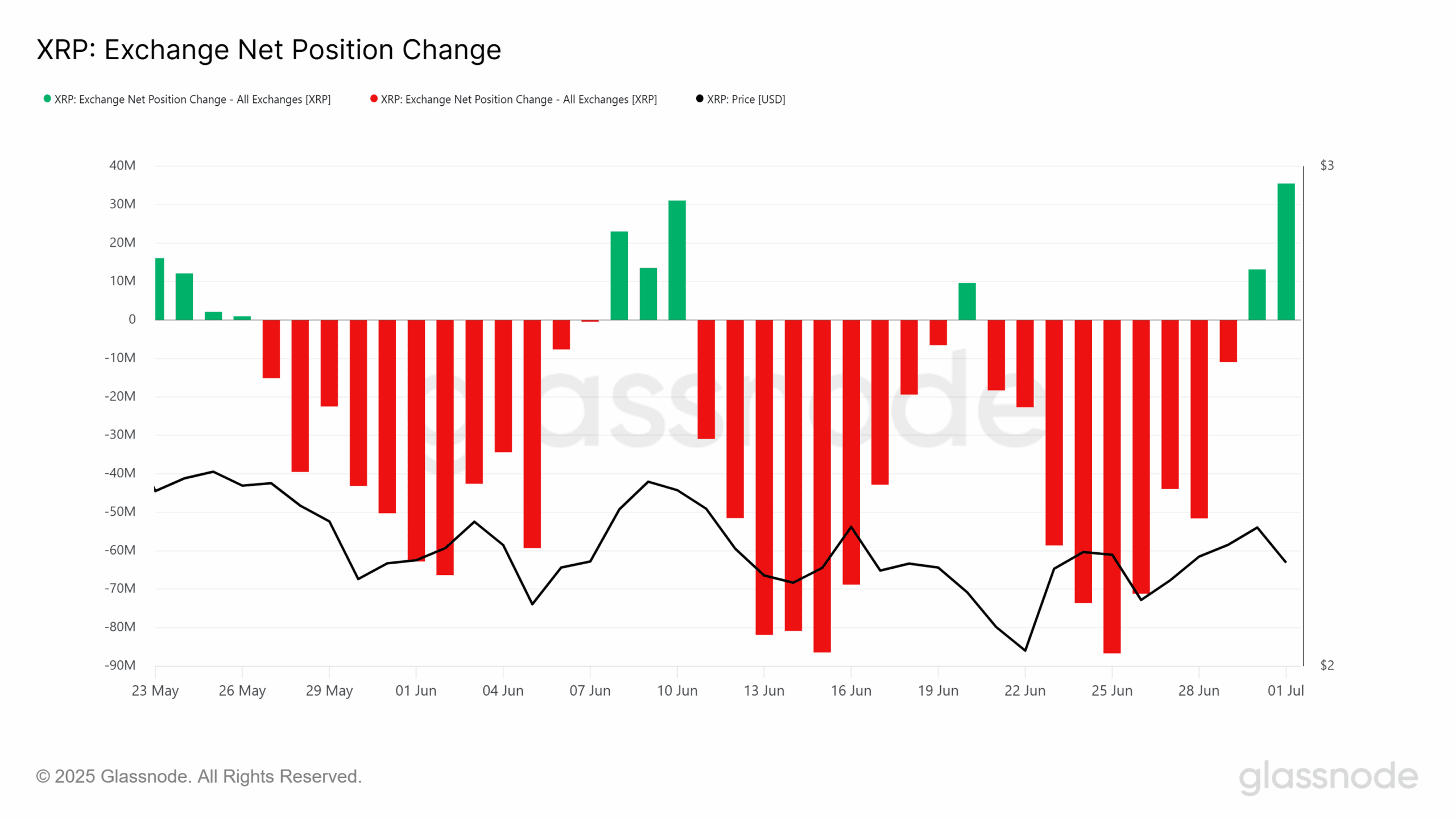

Such a development could bring in a massive wave of institutional investment into XRP, much like what has happened with Bitcoin and Ethereum. Another aspect of this speculation is the recent approval of Grayscale’s Digital Large Cap Fund (GDLC) to convert into a spot ETF.

The GDLC includes XRP alongside other major assets like Bitcoin, Ethereum and Cardano. While this doesn’t mean it has a dedicated ETF yet, it is still a step in the right direction.

According to data from PolyMarket, the odds of a direct ETF approval now sit at around $88%, up from 57% in January.

Overall, XRP’s price action can be interpreted as “coiling up for a bigger move.”

Analysts like Mikybull Crypto believe that if the bulls step in, it could fly toward $3.35 and gain nearly 50% from current levels. But this outcome depends heavily on whether XRP can break through $2.35 in the near term and stay above its major support levels.

On the flip side, if the price falls below $2.00, the bears will step in massively and drag XRP closer to the realized price level around $1.00.

A Launchpad for a Rally?

Even with the current issues with price, the crypto is still an investor favorite. The tight consolidation range might be frustrating to some. Still, it serves as a great launchpad for a breakout, especially if ETF news turns out positive.

Historically, the token has seen explosive rallies after long periods of price compression. This means that if the ETF is approved or the market regains its bullish standing, XRP could be ready for a burst past $2.35 and beyond.

Traders looking for entry points are keeping a close watch on how XRP behaves near support at $2.00 and resistance at $2.35. A clean break above or below either of these levels could dictate the next trend.