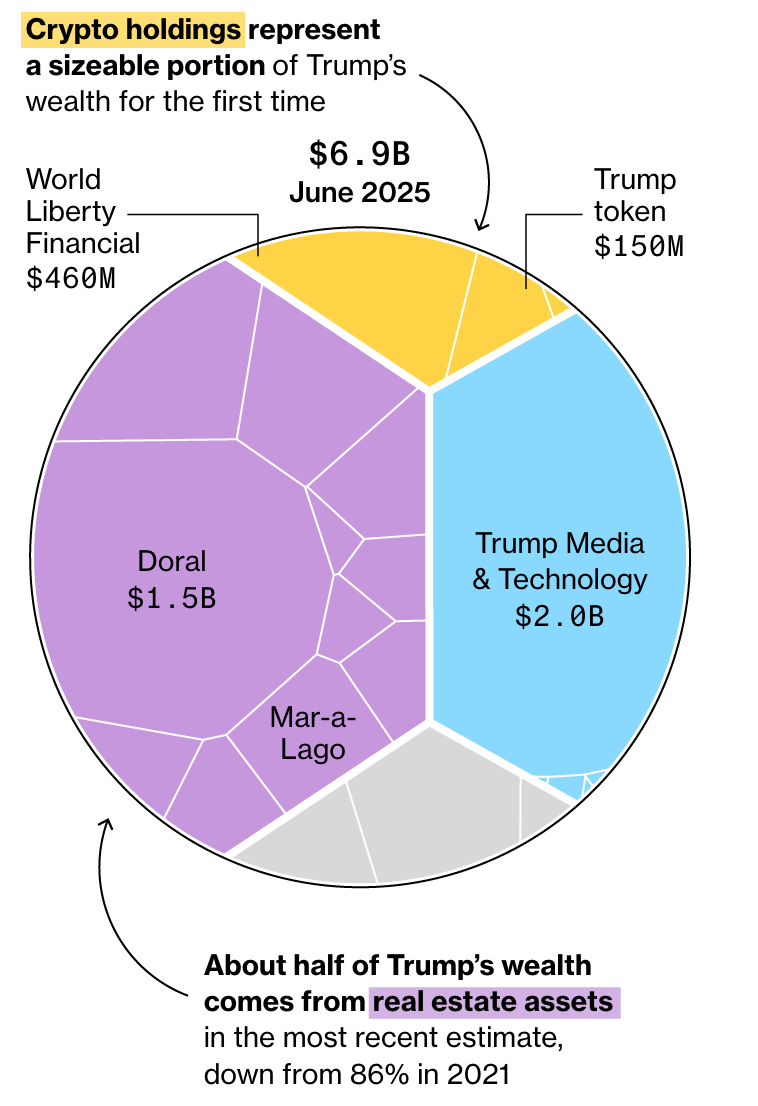

Donald Trump’s crypto holdings reached $620 million by mid-2025, according to a Bloomberg report. This figure represents 9% of his $6 billion estimated net worth. The rise comes mainly from World Liberty Financial and the TRUMP token.

While real estate and Trump Media and Technology Group still dominate his portfolio, the report notes this is the first time crypto formed a major portion of his wealth. Trump’s crypto involvement also includes ventures tied to his sons.

World Liberty Financial Drives Largest Crypto Gains

Trump and his three sons earned $390 million from $550 million in token sales at World Liberty Financial. They also hold more than $2 billion in the platform’s WLF governance tokens.

The company completed a $2 billion deal involving MGX, an investment firm based in Abu Dhabi. MGX used World Liberty Financial’s USD1 stablecoin to settle the transaction with Binance. Bloomberg reported this deal could have added another $100 million to the platform’s value.

All holdings were confirmed through internal company data reviewed in the report.

Trump Token Holdings Valued at $150M

Trump’s personal holdings in the TRUMP token, launched earlier in 2025, are currently worth around $150 million. The token trades at $8.89 and follows a gradual unlock schedule over three years. It is unclear if Trump will receive more tokens in the future.

The memecoin gained attention after Trump announced a private dinner and “VIP tour” for the top 220 tokenholders. The announcement led to criticism from lawmakers over potential ethics violations.

Donald Trump Jr. and Eric Trump own 20% of American Bitcoin, a subsidiary of mining firm Hut 8. The company raised $220 million for mining equipment and Bitcoin purchases. It also plans to merge with Gryphon Digital Mining to go public.

The sons’ involvement adds to the family’s crypto exposure beyond token sales and governance holdings.

Lawmakers Target Trump Conflict of Interest in Crypto

Trump’s crypto ventures have led to renewed calls for legislation. Since January, Democratic lawmakers have introduced bills and amendments to block U.S. officials and their families from promoting or owning digital assets.

During a Senate budget debate, Senator Jeff Merkley proposed an amendment addressing Trump’s crypto holdings and ownership ties. The proposal has not advanced due to the Democratic minority inCongress. However, the issue remains active in legislative discussions.