- Bhandari urges Bitcoin reserve pilot to strengthen India’s economy.

- Bhutan crypto success cited as roadmap for India’s Bitcoin policy.

- India poised for leadership as global crypto adoption rapidly accelerates.

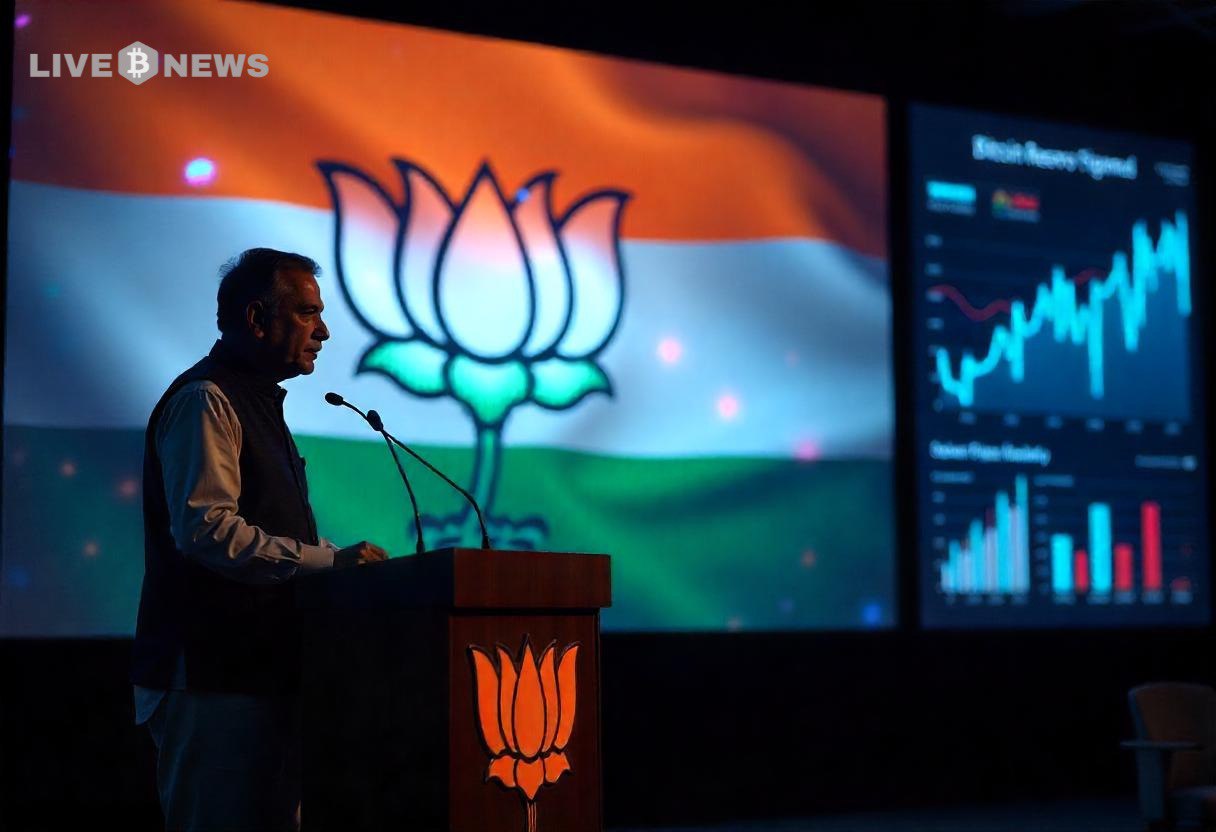

Pradeep Bhandari, the national spokesperson for India’s ruling Bharatiya Janata Party (BJP), called for a Bitcoin reserve pilot in India. He believes this would be a strategic and forward-looking move, especially as other nations are already taking action in the crypto space. The proposal explains the increasing global usage of Bitcoin and indicates that India cannot be left behind.

Bhandari Highlights Bhutan’s Crypto Success as Model for India

Bhandari sees the creation of a strategic Bitcoin reserve in the United States and the state-driven mining in Bhutan as firm indicators that the world financial system is on the path to digital assets. He said India, with an expanding renewable energy industry, is in a good position to develop its own independent Bitcoin policy. He explained, “This is not a careless switch but a strategic move in the direction of accepting the legitimacy of digital assets.”

Additionally, he clarified that the case of Bhutan demonstrates how digital assets can assist in the stability of smaller economies. This strategy will boost India’s economic resilience as it grows into a major technological and financial center. However, Bhandari was also aware of all the difficulties that India could encounter, such as severe regulation and the scope of such a national undertaking.

He observed that Bitcoin is unique, unlike traditional assets. It does not have a central issuer, as stocks or fiat currencies do. No government, bank, or corporation controls it. This is the decentralized aspect that makes Bitcoin strong and attractive. It is valuable because of three main characteristics, which are scarcity, liquidity, and transparency.

There will be only 21 million Bitcoins. Unlike traditional currencies that governments can print endlessly, Bitcoin has a fixed supply of 21 million coins. This predetermined cap protects it from inflation, offering a built-in scarcity similar to gold. However, unlike gold, Bitcoin can be traded 24/7 across the globe, making it more accessible to investors. Furthermore, while gold often remains stored in vaults or used in jewelry, Bitcoin maintains strong liquidity through constant, active trading.

Bitcoin Reserve Could Signal India Digital Finance Leadership

Another major benefit of Bitcoin is its blockchain, a secure and unchangeable digital ledger. The technology makes the system transparent and far more difficult to tamper with than conventional finance, since anyone can verify all transactions.

Meanwhile, the local crypto market in India is lobbying against a rigorous tax regime on crypto that was enforced last year. Currently, the government taxes crypto profits at 30% and each transaction at 1%. Such high taxation has propelled most of the crypto trading in India overseas. However, India could take a softer approach, partly since the political landscape of the world is also changing, with the likelihood that pro-crypto leaders such as Donald Trump could take power again in the U.S.

Ultimately, it is a turning point of India. The world is getting behind Bitcoin and India has the infrastructure and human capital to take the lead in this direction. The first step towards creating a balanced, progressive crypto policy might be a pilot project in the form of a Bitcoin reserve. It would be a sign of modernity, a world-grabbing headline, and India could be stronger in the financial sense in the future.