Disclaimer: This article is for informational purposes only and does not constitute financial advice. BitPinas has no commercial relationship with any mentioned entity unless otherwise stated.

Atty. Rafael Padilla, the author of the book “Crypto and the Law,” urged the Philippine Securities and Exchange Commission (PH SEC) to exempt decentralized finance (DeFi) protocols and non-custodial wallets from its newly released Crypto Asset Service Provider (CASP) rules.

Padilla on Why DeFi and Non-Custodial Wallets Should be Exempted

Speaking during the June 11, 2025, edition of the BitPinas Webcast titled “SEC Final Crypto Rules: What #CryptoPH Needs to Know,” Padilla emphasized that decentralized systems, especially those that are “sufficiently decentralized in substance,” should not fall under the CASP regulatory framework.

For the crypto lawyer, it is important to push for clearer regulatory exemptions for DeFi systems and wallets, particularly those that do not involve fund custody or intermediaries. He argued that if a platform is genuinely decentralized, it should fall outside the scope of the PH SEC’s CASP rules.

Padilla pointed out that the way crypto content is presented, such as through product placements, could potentially be considered as touting, depending on its tone and visibility. However, he noted that promotional material centered purely on decentralized tools, like non-custodial wallets, might not attract the same level of regulatory concern.

He also acknowledged that the current rules may be interpreted broadly but stressed the importance of proper implementation and enforcement.

“Despite how the CASP rules are currently worded, I hope that in terms of enforcement, the SEC will realize this should only apply to crypto asset securities.”

Atty. Rafael Padilla

Accordingly, Padilla cited a key precedent from the U.S. involving the case of the U.S. SEC vs. Coinbase. In that case, the U.S. Court of Appeals ruled that Coinbase’s decentralized wallet does not constitute securities brokering and therefore does not require broker registration.

He pointed to this case as a legal basis for excluding decentralized tools from regulatory requirements.

Lastly, Padilla also urged the #CryptoPH community to be involved in calling out the PH SEC to exempt DeFi projects.

“As a community, as an ecosystem, we have to advocate that the decentralized ecosystem should be carved out from this regulation. They should not be treated as CASPs.”

Atty. Rafael Padilla

U.S. SEC as Reference

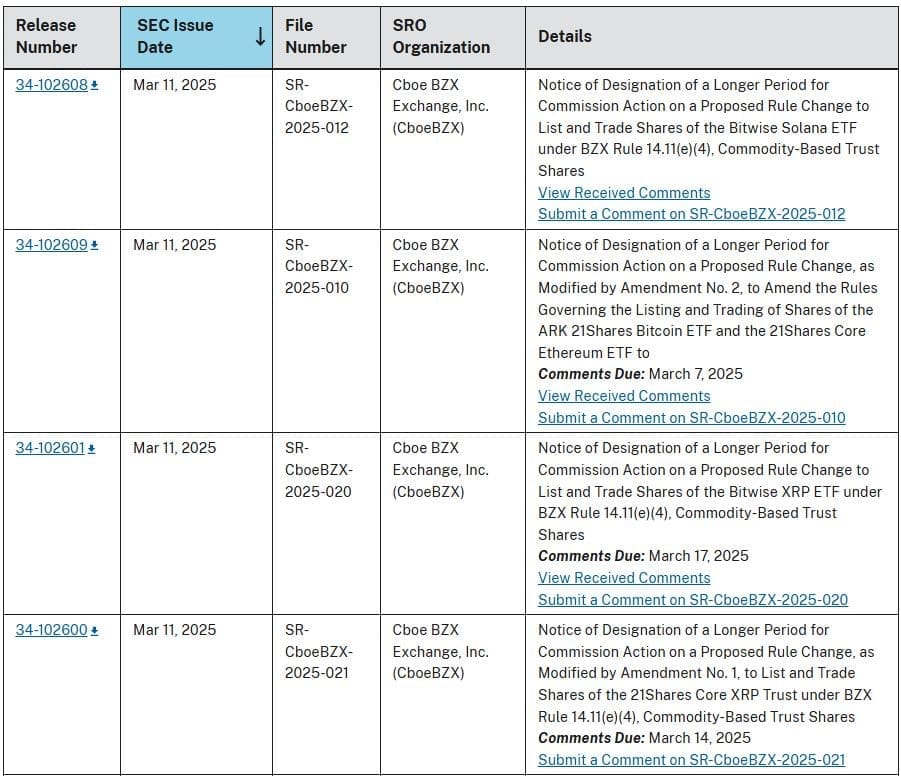

Padilla also observed a contrast between how the U.S. SEC and the PH SEC interpret similar crypto regulations. Despite having nearly identical regulatory standards, he noted that differences in enforcement and interpretation have emerged, possibly influenced by changes in leadership and administrative direction.

The crypto lawyer then emphasized that enforcement of the CASP rules in the Philippines should focus specifically on crypto asset securities. He encouraged local regulators to consider both international policy approaches and court rulings, particularly those from the U.S. SEC and judiciary, which increasingly distinguish decentralized systems from custodial service providers.

“In the Philippines, we do not yet have court rulings on these matters, no decisions from the Court of Appeals or the Supreme Court… But in the U.S., even lower court rulings are publicly reported, and some cases have reached the Court of Appeals.”

Atty. Rafael Padilla

Padilla cited the growing legal consensus in the U.S., supported by SEC Commissioners like Hester Peirce, Mark Uyeda, and Chairman Paul Atkins, which holds that crypto assets, in and of themselves, are not securities. This evolving interpretation, he said, should serve as a reference for Philippine regulators moving forward.

What is with the SEC CASP Rules?

Under Memorandum Circulars No. 4 and 5, the regulations require CASPs to register as stock corporations, obtain a special license, maintain a physical office, and follow strict marketing, disclosure, and anti-money laundering requirements.

Marketing through influencers, events, or social media is also strictly regulated under the new rules, with violations potentially resulting in fines or the revocation of licenses.

In line with this, Atty. Padilla cautioned that previously published crypto-related social media posts could still breach the SEC’s CASP regulations if they remain publicly viewable, as they may be considered “continuing violations.”

Check out BitPinas webcasts and articles about the SEC CASP Rules:

This article is published on BitPinas: Lawyer Urges SEC: DeFi Projects Should be Exempted from CASP Rules

What else is happening in Crypto Philippines and beyond?