SharpLink completed a major ETH acquisition totaling 31,487 ETH across two days. On July 12, blockchain data from EmberCN via Arkham Intelligence showed that SharpLink ETH purchase included 14,693 ETH from Galaxy Digital and 6,804 ETH from Coinbase Prime, worth $43.89 million and $20.37 million respectively.

The day before, SharpLink bought 10,000 ETH directly from the Ethereum Foundation for $25.7 million. In total, the company acquired over $90 million in ETH during this period.

These transactions came as the ETH price crossed $3,000 on July 11, marking the first time it reached that level since February 2025. SharpLink’s aggressive move added significantly to its 253,000 ETH treasury.

SharpLink Ethereum Holdings Now Total 253,000 ETH

SharpLink now holds 253,000 ETH, according to Arkham Intelligence. The firm has staked and restaked the full amount, using Ethereum’s network to earn additional yield.

At current prices, SharpLink Ethereum holdings show an unrealized profit of around $45 million. All tokens remain within staking contracts, meaning the assets are not active on exchanges.

The activity followed ETH’s rise above $3,000, which appears to have accelerated corporate accumulation. No part of the holdings has been sold. The ETH remains staked, following a consistent pattern over several months.

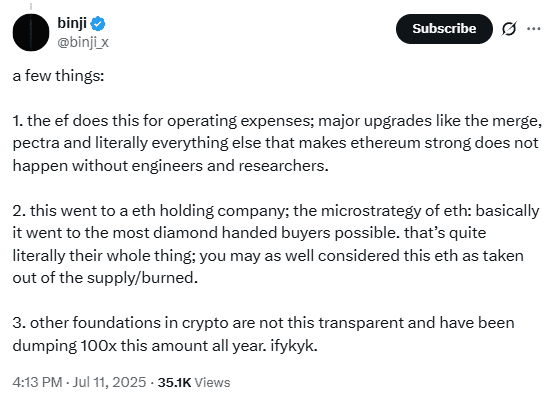

Ethereum Foundation ETH Sale Draws Mixed Reactions

The Ethereum Foundation ETH sale on July 11 was worth $25.7 million and involved 10,000 ETH. The Foundation confirmed that it used its treasury policy, last updated on June 4, 2025, to manage fiat reserves.

That policy allows the Foundation to convert ETH into fiat when reserves fall below a level that covers operating costs and a multi-year buffer. The funds will go toward protocol research, grants, and ecosystem development.

Binji Pande, a contributor to the Ethereum Foundation, commented on X that this ETH went to “the most diamond-handed buyers possible”, describing SharpLink as long-term focused.

Joseph Lubin ETH Strategy Supports Ethereum Network

SharpLink’s Joseph Lubin ETH strategy emphasizes long-term involvement. Lubin, who also co-founded Ethereum, explained that the company is buying, staking, and restaking ETH to strengthen the network.

He said,

“We see this as the start of something bigger — a model for how mission-driven organizations can work to advance our ecosystem’s shared goals of decentralization, economic empowerment and protocol-native finance.”

Lubin did not mention any plans to sell or reduce SharpLink Ethereum holdings. Instead, he confirmed that the ETH remains part of a larger vision aligned with Ethereum’s core goals.

Galaxy Digital ETH Deal and Coinbase Prime ETH Transaction

The Galaxy Digital ETH deal involved 14,693 ETH sold to SharpLink for $43.89 million. The trade happened on July 12. On the same day, Coinbase Prime ETH transaction delivered 6,804 ETH to SharpLink for $20.37 million.

These large-scale purchases were split between regulated institutional platforms. Both Galaxy and Coinbase Prime cater to high-volume crypto clients, including funds and treasury teams.

The SharpLink ETH purchase from these two platforms followed the Foundation sale and took place during rising market activity tied to the broader altcoin cycle.

SharpLink Ethereum Staking Profit Approaches $45 Million

As of mid-July, the Ethereum staking profit from SharpLink’s position remains unrealized. However, based on current market value, it totals nearly $45 million.

The ETH remains locked in staking and restaking protocols. This setup contributes to network security and keeps the tokens out of circulating supply.

Arkham Intelligence tracks these profits through wallet activity, showing no movement away from staked positions since accumulation began.

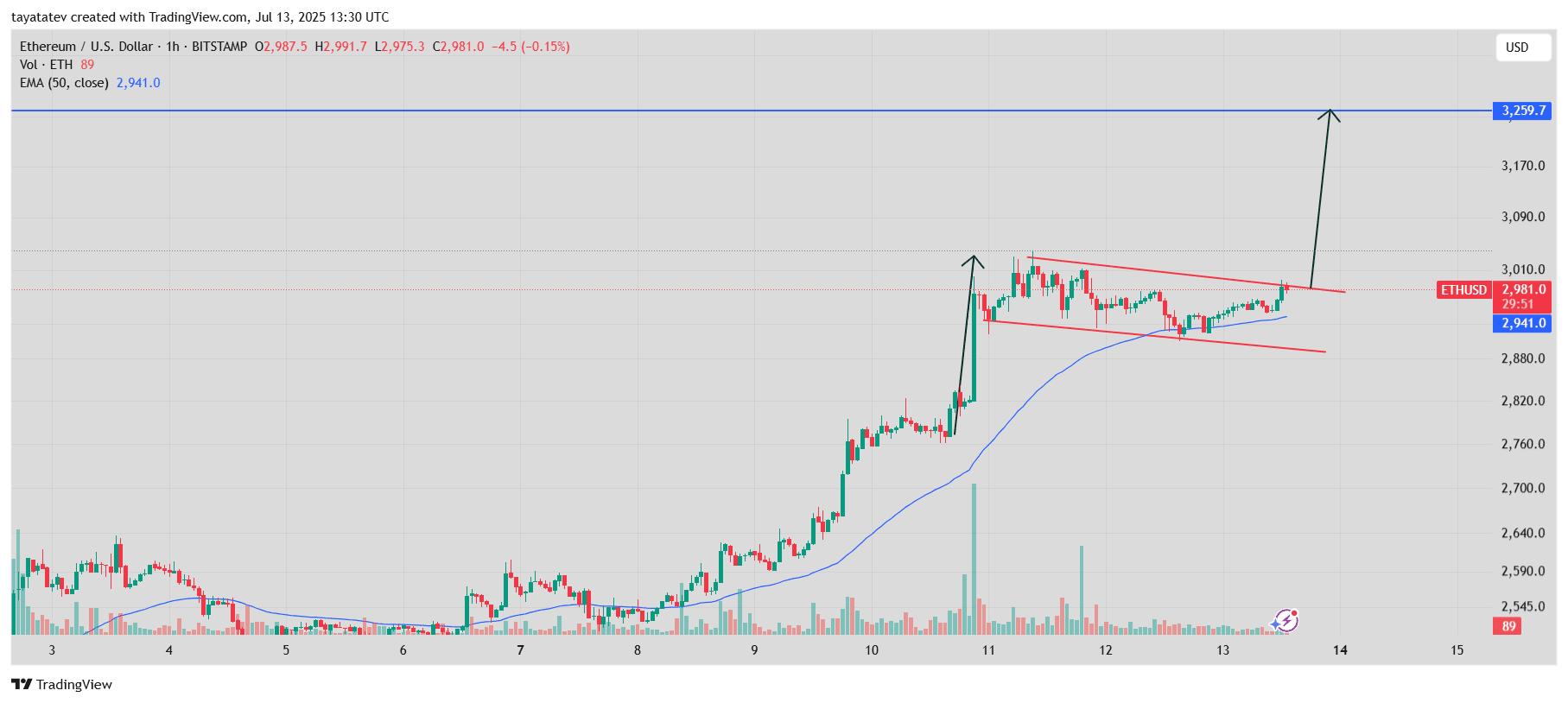

Ethereum Prints Bullish Flag Pattern on July 13, Eyes 9% Breakout to $3,259

Ethereum ETH/ USDT formed a bullish flag pattern on the 1-hour chart, according to data from TradingView, captured on July 13, 2025, at 13:30 UTC. The price at the time was $2,981.

A bullish flag pattern occurs when a strong upward move (flagpole) is followed by a downward-sloping consolidation channel (the flag). This pattern usually indicates that the price may resume its prior upward direction once it breaks above the flag’s resistance line.

In this case, Ethereum surged sharply on July 11, pushing past $3,000. After the spike, the price moved sideways and slightly downward within a narrow range. This consolidation formed a descending channel bounded by two red trendlines.

As of July 13, ETH traded near the upper boundary of this channel, close to confirming a breakout. If Ethereum closes above this line with volume support, the flag pattern will confirm. Based on the measured move of the flagpole, the projected upside target is $3,259. This level sits 9.3% higher than the current price of $2,981.

The chart also shows the 50-period Exponential Moving Average (EMA) at $2,941, providing dynamic support since July 11. The price has remained above this EMA, reinforcing the bullish momentum.

A confirmed breakout with rising volume may trigger a push toward the $3,259 resistance line. Until then, the pattern remains incomplete.

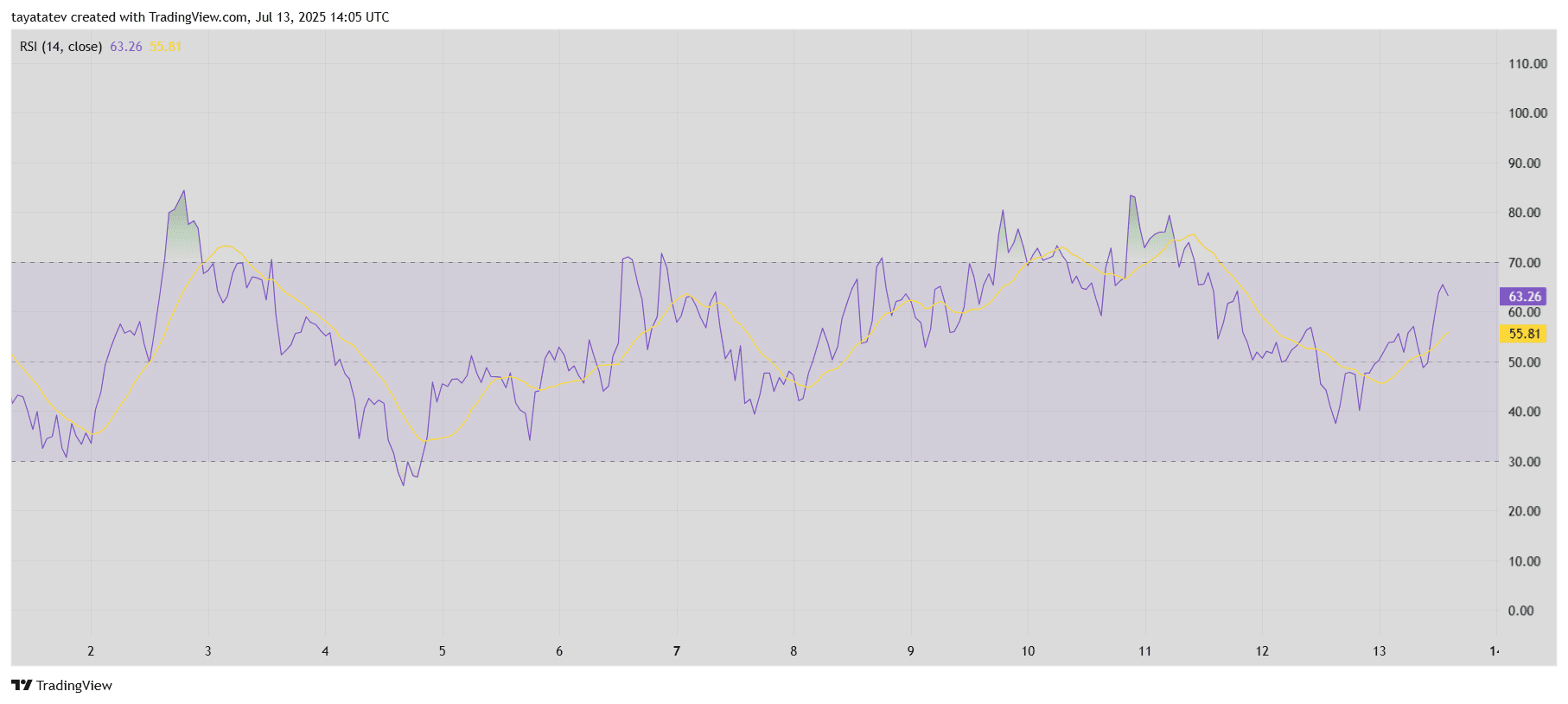

Ethereum RSI Bounces Toward Bullish Zone on July 13, Momentum Rebuilds

Ethereum’s Relative Strength Index (RSI) shows signs of renewed momentum, according to the chart captured on July 13, 2025, at 14:05 UTC, via TradingView.

The RSI (14), a technical indicator that tracks price momentum over 14 periods, is currently at 63.26. The RSI has crossed above its moving average, which stands at 55.81. This crossover signals increasing strength in Ethereum’s recent price action.

An RSI reading above 50 typically indicates that buying pressure is stronger than selling pressure. When the RSI approaches or exceeds 70, it can suggest overbought conditions. However, Ethereum’s RSI remains just below that threshold, pointing to a zone where momentum is rising but not overheated.

Since July 12, the RSI had fallen below 50, but by July 13, the indicator turned upward and pushed through the 60 mark. This upward movement aligns with Ethereum’s price climbing back toward $3,000.

The steady rise of the RSI toward the upper band suggests increasing interest in ETH without showing extreme conditions. If momentum continues and RSI moves above 70, the chart may reflect short-term overheating. Until then, the market appears to be in a balanced but strengthening trend.