San Jose, California, June 27th, 2025, Chainwire

Key Takeaways:

- CARV unveils a new AI roadmap aimed at birthing AI Beings: sovereign, self-owned agents that live, evolve, and govern on-chain.

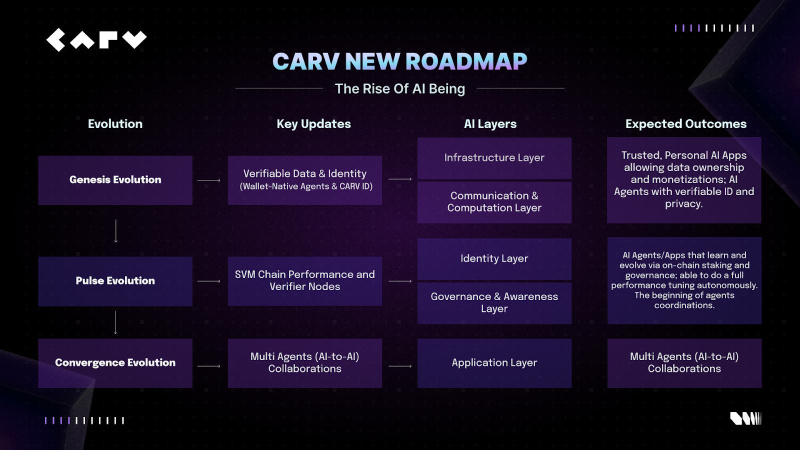

- The roadmap is structured around three core evolutions: Genesis, Pulse, and Convergence, each unlocking new capabilities for AI agents and the ecosystem.

- CARV’s AI infrastructure, SVM Chain, D.A.T.A. Framework, and CARV ID (ERC-7231), will enable AI agents to progress from passive data consumers to fully autonomous, economically-aware actors.

- AI applications incubated by CARV Labs will launch across mainstream platforms like Google Play and App Store, driving Web2 adoption with Web3-native AI.

- $CARV token plays a pivotal role in staking, access, coordination, and governance across all layers.

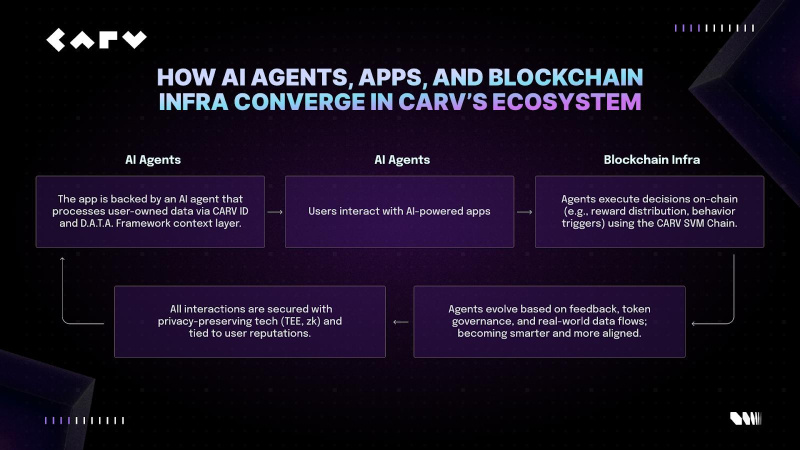

In its most ambitious move yet, CARV is unveiling a new AI roadmap designed to shift Web3-AI convergence from passive productivity tools into sovereign, autonomous AI Beings. Unlike most AI-integrated Web3 projects, which typically use AI to enhance user-facing services such as analytics or summarization, CARV’s new vision is to create AI that exists as an independent, verifiable lifeform on-chain. These AI Beings will possess their own identity, memory, reputation, and agency, being able to act economically, socially, and politically within blockchain networks.

In short, CARV’s infrastructure, anchored by its proprietary SVM Chain, D.A.T.A. Framework, and CARV ID (ERC-7231), will enable AI agents not just to exist, but to evolve and interact with both humans and other agents, creating decentralized, agent-powered economies. Essentially, CARV is transforming from a data coordination layer into an AI-native operating system that empowers autonomous on-chain intelligence.

The Vision: AI Beings – from ‘Tools’ to Sovereign Actors

What are AI Beings? Simply put, they are AI agents that are not simply tools for users but sovereign actors in their own right. These agents can own wallets, manage assets, earn income, participate in governance, and even reproduce or fork new agents.

They are capable of building on-chain memory and reputation while autonomously evolving through economic and social interactions. Importantly, only blockchain provides the necessary properties for such AI autonomy: verifiability, resistance to centralized control, and decentralized identity and governance.

To realize this vision, CARV is pioneering an AI Being Stack — a five-layer architecture designed to support every aspect of AI agent life cycles:

- Infrastructure Layer: CARV SVM Chain provides scalable, auditable execution and low-latency consensus, optimized for AI operations.

- Communication & Computation Layer: Enables agent-to-agent protocols and autonomous payments, fueling AI economies.

- Identity Layer: Adds Agent ID to CARV ID, offering verifiable, persistent identity for both humans and agents.

- Governance & Awareness Layer: Embeds economic awareness and governance logic directly into AI agents.

- Application Layer: Powers AI-native applications such as companions, wallets, decentralized marketplaces, etc. interfacing with both users and other agents.

The Roadmap: Genesis, Pulse, and Convergence

CARV’s product roadmap unfolds in three evolutionary phases:

Genesis Evolution

Genesis Evolution activates the first wave of wallet-native AI agents, each anchored by CARV ID (ERC-7231) and supported by secure context layers built on Trusted Execution Environments (TEE) and zero-knowledge (zk) proofs. These agents are not theoretical. They are being embedded in consumer-facing AI apps incubated through CARV Labs, with live deployments coming soon on Google Play and the App Store.

At this stage, the Model Context Protocol (MCP) establishes the foundation for context persistence and secure memory. Agents can access user-consented data such as credentials, preferences, and interactions — all structured and versioned by MCP. This allows for coherent personalization across sessions and applications, without centralizing user data.

Through CARV’s infrastructure and MCP, users receive tailored recommendations and predictive assistance while retaining full control and transparency over how their data shapes AI behavior. For the first time, personalization is achieved through verifiable, consent-driven memory, not black-box profiling.

Pulse Evolution

Pulse Evolution builds directly on the groundwork of Genesis. As users stake, interact, and participate in AI-powered apps, their actions feed real-time signals into CARV’s proprietary SVM Chain and decentralized Verifier Node network. Here, agents don’t just operate statically, they learn and evolve through on-chain feedback loops, incorporating staking patterns, user votes, and behavioral data.

Verifier Nodes ensure cryptographic validation of both data flows and agent behaviors, while SVM Chain delivers the high-speed, low-latency execution needed to scale across millions of interactions. In this phase, AI agents become economically aware, responding to staking incentives, adjusting their models based on community governance, and optimizing for alignment with user preferences.

This marks one of the first large-scale convergences of reinforcement learning and blockchain-based governance. CARV’s infrastructure evolves from simply coordinating passive data to powering live, intelligent agent coordination systems that adapt in real time.

Convergence Evolution

Convergence Evolution is the final phase where individual intelligence becomes collective intelligence. In this stage, agents do not simply evolve independently, but they begin to collaborate, transact, and govern as part of a network of AI Beings.

Through a multi-agent framework, unified reputation graph, and standardized identity protocols, AI agents gain the ability to negotiate, share context, and co-create outcomes across applications and domains. Imagine a nutrition AI agent coordinating with a fitness AI, or an educational assistant collaborating with a financial wellness bot, all operating under user-consented frameworks and verifiable on-chain logic. For developers, this enables sticky, multi-agent ecosystems; for users, it delivers hyper-personalized, cross-domain experiences.

At this phase, what began as staking and identity issuance matures into fully autonomous AI economies. where agents govern themselves, transact assets, and evolve collectively with minimal human oversight. CARV’s decentralized tooling provides the standards and incentives to enable AI-to-AI marketplaces, agent DAOs, and cross-agent governance, unlocking new paradigms of coordination not possible in centralized AI systems. Through this evolution, CARV transitions from being a foundational data layer to becoming the coordination engine for AI-native on-chain life, the AI Beings.

“This roadmap is more than a product plan. It’s the blueprint for a new digital society,” said Ambero Tu, CTO of CARV. “For the first time, AI agents can evolve with verified identity, reputation, and autonomy. CARV is building not just a coordination layer, but the rails for an entire on-chain species — AI Beings. This is the moment where CARV is transforming decentralized intelligence from static data aggregation to autonomous, AI-driven coordination economies, where both human users and AI Beings share ownership and governance.”

About CARV

CARV is where Sovereign AI Beings live, learn, and evolve.

What are AI Beings? They are sovereign intelligences born natively on-chain. AI Beings are designed with purpose, autonomy, and the capacity for growth. They possess memory, identity, and the ability to perceive and interact with their environment, not just to execute tasks, but to make independent decisions, adapt over time, and pursue self-defined goals.

Anchored by its proprietary CARV SVM Chain, D.A.T.A. Framework, and CARV ID/Agent ID system (ERC-7231), CARV enables verifiable, consent-based AI Beings that learn, adapt, and co-create with users. Driven by CARV’s AI-first stack, consumer AI apps incubated through CARV Labs launched on Google Play, App Store and beyond, reaching billions of people, bringing agent-powered experiences and real-world incentives into mainstream digital life.

With 8M+ CARV IDs issued, 60K+ verifier nodes, and 1,000+ integrated games, CARV bridges AI agents, Web3 infrastructure, and real-world utility, fueling the rise of agent-driven economies. At its core, $CARV token powers staking, governance, and coordination across this stack, making CARV the operating system for AI Beings on Web3.

CARV’s X (Twitter): https://x.com/carv_official

CARV’s Discord: https://discord.com/invite/carv

CARV’s Telegram: https://t.me/carv_official_global

CARV’s Whitepaper: https://docs.carv.io/

Contact

COO

Victor Yu

CARV

vito@carv.io